There are two very different realities for the Group within the real-estate sector. On the one hand, net exposure from the developer segment (lending to developers plus the developers’ foreclosed assets) has been falling every quarter, and will continue to decline in the future. On the other, there are the retail foreclosures, i.e. the foreclosed assets from the residential mortgage sector. Their increase is linked to the increase in gross additions to NPA in this portfolio in 2008 and 2009, and in the short term they are expected to continue to rise.

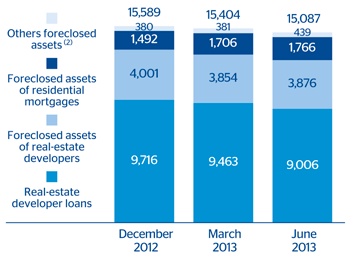

Overall, BBVA’s net exposure to the real-estate sector in Spain is still declining. As of 30-Jun-2013, the balance is of €15,087m, down 2.1% on the close of the previous quarter.

Total coverage of real-estate exposure closed the quarter at 44%, the same figure as at the close of March 2013.

Within the exposure to the Spanish real-estate sector, from residential mortgages have increased by 3.5% compared with the close of March. As has been noted, their rise is closely linked to the increase in gross additions to NPA in this mortgage portfolio during 2008 and 2009.

Lastly, is worth noting the increased pace of sales of properties. In this regard, during the first half of 2013 there have been 6,617 unit disposals, equivalent to a quarterly average of 3,309 units compared with 2,512 units quarterly average the previous year.

Spain. Real-estate. Net exposure to real-estate (1)

(Million euros)

Coverage of real estate exposure in Spain

(Million of euros as of 30-06-13)

|

|

Risk amount | Provision | % Coverage over risk |

|---|---|---|---|

| NPL + Substandard | 9,132 | 4,269 | 47 |

| NPL | 7,415 | 3,718 | 50 |

| Substandard | 1,717 | 551 | 32 |

| Foreclosed real estate and other assets | 12,570 | 6,489 | 52 |

| From real estate developers | 8,863 | 4,987 | 56 |

| From dwellings | 2,908 | 1,142 | 39 |

| Other | 799 | 360 | 45 |

| Subtotal | 21,702 | 10,758 | 50 |

| Performing | 5,405 | 1,262 |

|

| With collateral | 4,858 |

|

|

| Finished properties | 3,008 |

|

|

| Construction in progress | 677 |

|

|

| Land | 1,173 |

|

|

| Without collateral and other | 547 |

|

|

| Real estate exposure | 27,107 | 12,020 | 44 |