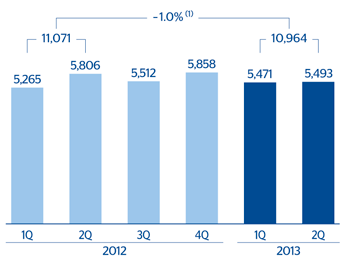

Gross income in the second quarter of the year stands at €5,493m, up 0.4% on the first quarter of 2013, but 5.4% lower than the figure reported in the second quarter of 2012, which included the dividend from Telefónica. Accumulated gross income in the first half of the year is €10,964m, practically the same as the €11,071m posted from January to June the previous year.

Gross income

(Million euros)

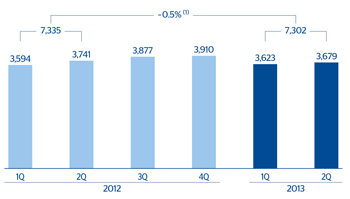

The resilience of net interest income has contributed to these stable earnings. In the second quarter of 2013 it stands at €3,679m, exceeding the figure registered the previous quarter. The amount accumulated over the first half of the year is €7,302m, slightly lower than the €7,335m posted last year, despite the negative impact of current low interest rates, which continue to exert high pressure on margins. In addition, complying with the Supreme Court judgment relating to limitation clauses on interest rates for residential mortgage loans (the “floor” clauses), BBVA has eliminated these clauses as of May 9, 2013, with the resulting negative effect on the Group’s net interest income.

Net interest income

(Million euros)

Breakdown of yields and costs

|

|

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

% of ATA | % yield/ Cost |

| Cash and balances with central banks | 4.2 | 0.99 | 5.2 | 0.95 | 4.8 | 1.19 | 4.2 | 0.82 | 3.7 | 0.98 |

| Financial assets and derivatives | 27.4 | 2.78 | 26.8 | 2.77 | 26.9 | 2.89 | 26.8 | 2.85 | 27.1 | 2.75 |

| Loans and advances to credit institutions | 4.4 | 1.57 | 4.4 | 1.54 | 4.0 | 1.58 | 4.4 | 1.80 | 4.4 | 1.90 |

| Loans and advances to customers | 56.2 | 5.58 | 55.9 | 5.55 | 56.5 | 5.83 | 57.1 | 5.60 | 57.9 | 5.75 |

| Euros | 33.4 | 2.97 | 34.0 | 3.08 | 34.2 | 3.20 | 34.4 | 3.23 | 34.8 | 3.43 |

| Domestic | 27.6 | 3.41 | 28.1 | 3.47 | 28.2 | 3.71 | 28.2 | 3.78 | 29.0 | 3.84 |

| Other | 5.8 | 0.85 | 5.8 | 1.23 | 6.1 | 0.85 | 6.3 | 0.77 | 5.8 | 1.35 |

| Foreign currencies | 22.8 | 9.43 | 22.0 | 9.37 | 22.3 | 9.88 | 22.6 | 9.20 | 23.1 | 9.24 |

| Other assets | 7.8 | 0.25 | 7.7 | 0.29 | 7.8 | 0.58 | 7.5 | 0.33 | 6.9 | 0.47 |

| Total assets | 100.0 | 4.03 | 100.0 | 3.99 | 100.0 | 4.24 | 100.0 | 4.10 | 100.0 | 4.23 |

| Deposits from central banks and credit institutions | 14.1 | 2.00 | 16.0 | 1.87 | 17.0 | 2.02 | 19.6 | 1.90 | 17.5 | 2.26 |

| Deposits from customers | 48.1 | 1.70 | 46.7 | 1.70 | 45.1 | 1.89 | 43.9 | 1.82 | 45.2 | 1.80 |

| Euros | 24.6 | 1.35 | 24.0 | 1.28 | 23.3 | 1.39 | 22.4 | 1.25 | 23.1 | 1.31 |

| Domestic | 17.7 | 1.56 | 16.6 | 1.51 | 15.4 | 1.58 | 14.7 | 1.47 | 15.3 | 1.57 |

| Other | 7.0 | 0.83 | 7.3 | 0.77 | 7.9 | 1.04 | 7.6 | 0.83 | 7.8 | 0.81 |

| Foreign currencies | 23.5 | 2.06 | 22.7 | 2.13 | 21.8 | 2.41 | 21.6 | 2.41 | 22.1 | 2.31 |

| Debt certificates and subordinated liabilities | 16.2 | 2.77 | 16.5 | 2.73 | 16.8 | 2.69 | 15.8 | 2.69 | 16.6 | 2.68 |

| Other liabilities | 14.0 | 0.88 | 13.7 | 1.06 | 14.1 | 1.14 | 13.8 | 0.89 | 13.8 | 0.70 |

| Equity | 7.6 | - | 7.2 | - | 7.0 | - | 6.8 | - | 6.9 | - |

| Total liabilities and equity | 100.0 | 1.67 | 100.0 | 1.69 | 100.0 | 1.81 | 100.0 | 1.72 | 100.0 | 1.75 |

| Net interest income/Average total assets (ATA) | 2.36 | 2.30 | 2.43 | 2.38 | 2.47 | |||||

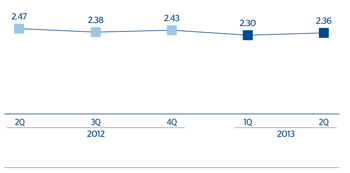

Net interest income/ATA BBVA Group

(Percentage)

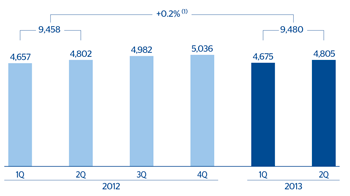

Fees and commissions in the quarter have contributed €1,126m, up on the figure for the previous quarter and the second quarter of 2012. Total fees and commissions for the first half of the year total €2,178m, up 2.6% on the same period last year, against a backdrop of reduced activity in developed markets and following the coming into effect of legal limitations on certain fees and commissions in some geographical regions.

Net interest income plus fees and commissions

(Million euros)

In line with the preceding quarter, NTI was once again high in the second quarter thanks basically to the Group’s global market units and good management of structural risks on the balance sheet. In an environment of low interest rates, this heading is supporting the Group’s revenue. NTI of €1,349m was posted in the first half of 2013, a figure considerably higher than the €801m reported in the same period of 2012.

An amount of €47m in dividends was registered in the second quarter, adding to a total of €66m for the first half of the year, significantly lower than the €338m posted in the first half of 2012, due basically to the temporary suspension of the payment of dividends by the Telefónica Group.

Earnings by the equity method from April to June 2013 stand at €164m, totaling €214m in the first six months, compared with €366m in the first half of 2012. This year-on-year decline is due to the smaller contribution by CNCB as a result of the coming into effect of new local regulations governing provisions.

Lastly, the other operating income and expenses heading, with a negative €146m in the first half of the year, was affected by the adjustment for hyperinflation in Venezuela, which has been more negative than in previous periods, as well as the year-on-year increase in the contribution to the deposit guarantee funds in the various geographical areas where the Group operates.