The highlights for the first six months of 2013 in the area’s income statement include:

- Pressure on margins in revenue, as a result of the current environment of low interest rates and very flat yield curves, and the slowdown in fees and commissions, due to increasingly restrictive regulation and the sale of the insurance business in 2012. As a result, the area has generated gross income of €1,073m, 5.5% less than in the first half of 2012.

- Cost control, as seen in the flat growth of operating expenses, which in the first half of the year have barely increased by 0.3% year-on-year to €733m.

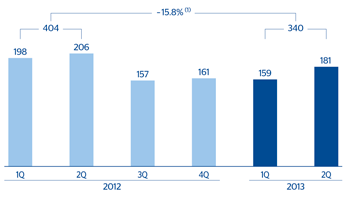

- Thus, operating income stands at €340m (down 15.8% year-on-year).

- Impairment losses on financial assets and provisions (net) and other gains/losses, which are €39m in the first half of 2013, have once again been reduced significantly, 42.5% over the last twelve months, thanks to the ongoing improvement in the area’s asset quality.

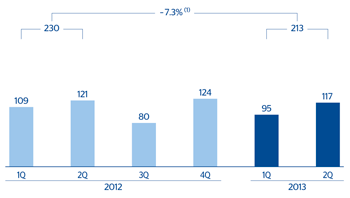

- In conclusion, over the first half of the year, the United States contributed €213m to the Group’s net attributable profit, i.e. 7.3% less than in the same period in 2012. However, the earnings from BBVA Compass, €186m, have practically maintained the same level reported twelve months earlier (down 0.4% year-on-year).

The United States. Operating income(Million euros at constant exchange rate) |

The United States. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: -17.0%. |

(1) At current exchange rate:-8.7%. |