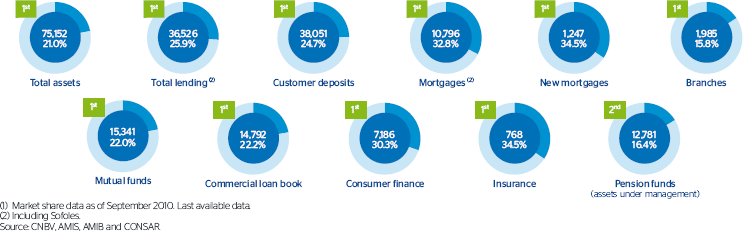

BBVA Bancomer is a leading financial institution in Mexico in multiple banking, pension funds, mutual funds and insurance, with a market share of operating income of 59%, managing just 36% of the total assets in the sector (1). It has a policy of strict risk control and a long-term objective of growth and profitability. As is the case with the Group as a whole, BBVA Bancomer is working towards a better future for people by offering its customers a mutually beneficial relationship, including consulting services and comprehensive solutions.

BBVA Bancomer provides services for over 16 million customers through specialized business units and distribution networks to cover the needs of each segment of customers. It has the largest branch network in Mexico, which are strategically located across the country, as well as one of the best networks of ATMs and point-of-sale terminals. As of the close of 2010, the area had 1,985 branches, 6,760 ATMs and 126,002 point-of-sale terminals. One of the highlights in this respect has been the new generation of ATMs introduced in 2010. Called practicajas and recicladoras (cash recyclers), they reduce the operational volume in branches and increase the sale of products through the self-service mode.

In 2010, a year that marked a transition for the area from the financial crisis to the start of economic recovery in the country, BBVA Bancomer successfully completed its Transformation Plan focused on increasing innovation and productivity. The area has focused on the following lines of action:

- Increasing new lending and attracting more funds than the competition.

- Maintaining the levels of recurrent earnings.

- Controlling manageable expenses, without limiting investment in technological innovation and networks that boost future growth.

- Maintaining adequate asset quality.

- Constructing and designing business initiatives to prepare strategic positioning with a view to boosting growth over the coming years.

- Maintaining the efforts designed to meet corporate responsibility objectives.

It is also worth highlighting the launch in 2010 of a new strategic plan designed to take advantage of the opportunities offered by Mexico for continued growth. The Strategic Growth Plan 2010-2012 covers all area units, including business, central services and corporate responsibility. It is an ambitious investment plan that will lead to a qualitative transformation of the business model, service, commercial efficiency (with commercial objectives and plans that are an important challenge for the area), control and monitoring of activity and risk, and thus the bank’s profitability as a whole.

Thus for 2011, the year of economic recovery, BBVA Bancomer will be in a privileged position to take advantage of this environment. It will be able to construct the bank of the future with its focus on customers and on a different form of relationship with them:

- Gaining more customers, basically through new banking penetration plans that take advantage of the opportunities for penetration to capture additional markets with potential for growth.

- Implementing a new clearer segmentation. This includes focusing on high-value customers and offering special services for customers that cannot be tied to the Bank.

- Increasing the loyalty of the customer base.

The new approach is supported by technology and a greater diversity of distribution channels.