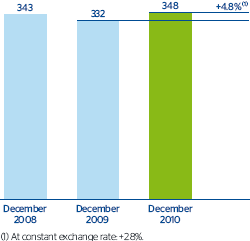

Gross lending to customers stood at €348 billion as of December 31, 2010, a year-on-year increase of 4.8%. Excluding the exchange-rate effect, the increase is a year-on-year 2.8%.

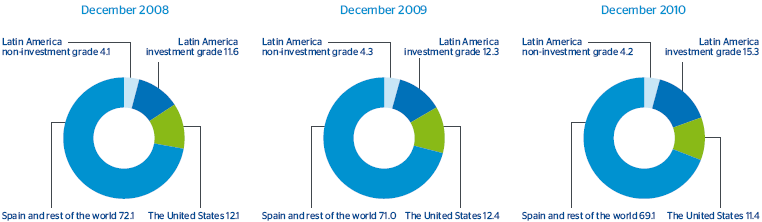

Lending has also varied by business area and type of portfolio. In Spain and Portugal, the Bank is continuing to win market share in high-loyalty products such as residential mortgages. At the same time, positions in the highest-risk portfolios are being reduced. In Mexico the rate of growth in practically all the business lines is speeding up. Of particular note is the outstanding performance of the commercial portfolio and the growth in consumer finance and credit cards. In South America activity continues to be strong, with a gradual improvement in growth rates over the year and increases across the board in practically all the countries. In the United States, the fall in lending is due to the reduction in items of greater risk, such as construction real estate and consumer finance, as residential real estate and, to a lesser extent, loans to SMEs and corporations increased significantly. This explains the increased weight of investment grade Latin America to 15.3% (12.3% the previous year), and the reduction by one percentage point in the share corresponding to the United States and Spain and the rest of the world (from 71.0% as of 31-Dec-2009 to 69.1% as of December 31, 2010).

Broken down by domestic and non-domestic sectors, among loans to domestic customers, lending to the public sector increased by 14.3% year-on-year to €24 billion. Loans to other residential sectors (ORS) increased by 1.1% in the same period. Out of this segment, the item with the lowest associated risk and greatest relative weight is secured loans, which totaled 56.5% of ORS loans, €105 billion. The items more related to the activity of companies and businesses and with consumption fell back less than in the previous year. Commercial loans, which basically include discounted bills, fell by 3.0% (–26.0% in 2009). Other term loans, which include consumer finance and corporate and business lending, fell by 0.4% (–16.3% in the previous year). Finally, non-performing assets remain under €11 billion at the close of the year, and have fallen for the first time for more than two years (–0.6% year-on-year).

Lending to non-domestic customers totaled €139 billion as of 31-Dec-2010, a year-on-year increase of 8.8%. The other loans heading grew by 9.6% over the year to €89 billion, and secured loans increased 7.6% to €46 billion. Finally, non-performing assets grew 4.3% owing to the exchange-rate effect. Not counting this, the decrease was 4.2% over the same period.