BBVA Compass represents approximately 74% of the area’s total assets and garners the retail and corporate banking business in the United States (excluding Puerto Rico).

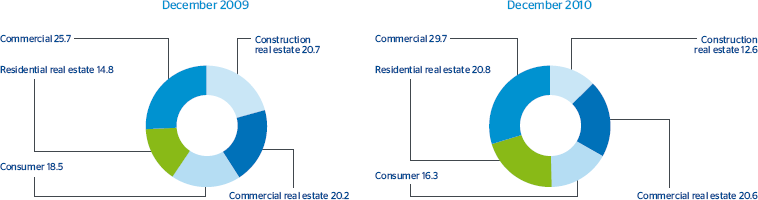

At the close of 2010, the loan book was down 7.1% year-on-year to €31,256m. The fall in lending is the result of reduced finance for construction real estate and the planned runoff in consumer finance for car dealerships and students. This drop has in part been offset by the increase in residential real estate, which was up 34.7% over the year; and to a lesser extent, by commercial loans, which were up 11.2% on 31-Dec-2009. It is worth noting that $3,294m in new residential mortgages were generated during the year, 22.3% up on the figure for the previous year. The residential real estate portfolio accounted for 20.8% of total lending in BBVA Compass as of December 31, 2010, compared with 14.8% in 2009, and commercial loans accounted for 29.7% (25.7% the previous year). In contrast, construction real estate was down 8.1 percentage points to 12.6% and consumer finance down 2.2 pp to 16.3%.

Customer deposits decreased by 1.8% year-on-year to €32,873m as a result of the fall in term deposits (–21.0%). Lower-cost funds such as current accounts were up by 7.7%.

The mix in the loan book and deposits has led to an increase in customer spread of 16 basis points over the year. This is because the interest rates accrued on customer deposits have fallen more than the yield on loans (despite the change in the mix towards items with lower risk and spread). As a result, the net interest income of €1,566m is 7.1% up on the figure for 2009, while net fees and commissions have increased by 1.0% over the same period. Although both net trading income and the other gains (losses) item were down, gross income ended the year at €2,168m, 2.7% up on 2009. However, the increased operating expenses, due to the process of integrating Guaranty, led to a 1.7% fall in the operating income over the previous year to €816m. Impairment on financial assets improved significantly, reflecting the exceptional measures taken in 2009 and the risk control mechanisms implemented over this year. As a result, the net attributable profit increased to €149m (compared with –€1,063m in 2009, or €42m without one-off charges, at constant exchange rates).

Below are the highlights of each of the units making up BBVA Compass:

- As of December 2010, Commercial Banking, the unit that handles business with SMEs, managed a loan portfolio of €15,927m (down 13.9% year-on-year) and customer deposits of €8,789m (up 7.2%). This is the result of a reduction in finance for real-estate developers (–45.2%), which was partly offset by a notable effort made by BBVA Compass with SMEs. A number of products have been launched aimed at SMEs, such as the Integrated Payables, which offers a way of combining payments into a single file and route them using the lowest cost method, and the updating of the Controlled Disbursement Account, which provides customers with the CDA Perfect Presentation reports that notify them of all the checks entering their accounts each day and thus enables companies to maximize their liquidity management.

- Corporate Banking, specialized in large corporations, has increased its loan book by 3.2%, with a major rise in deposits (up 80.5%).

- Retail Banking has a volume of loans of €10,730m (up 4.3%). The reduction in the auto dealer and student loan portfolios was more than offset by an increase in residential real estate. Customer funds fell by 6.8%, due to the 9.0% reduction in higher-cost funds, while more liquid funds increased by 2.8%. BBVA Compass and SmartyPig concluded a strategic alliance in 2010 through which BBVA Compass will act as a depositary for SmartyPig customers in the United States. Compass for your Cause, a program designed for NGOs and launched at the end of 2009, has not only tripled the number of organizations involved, but increased the number of donors to NGOs by more than 700%. Finally, in the health sector, joint teams have been formed made up of representatives from the Retail, Commercial, Wealth Management and Insurance units. They offer a wide variety of products, including a new service that allows payments to be collected from patients at medical consultations.

- The Wealth Management unit has a loan book of €2,047m, deposits of €3,686m and assets under management of €13,188m. In 2010 it launched the fixed-income product Fixed Annuity, which has attracted $350m in similar assets from other banks. The Managed Money plan offers customers who do not meet the typical Wealth Management profile the chance to have an investment account managed by professionals.

- Finally, the business in New York follows the same pattern as the rest of the WB&AM units in the Group: a focus on higher added-value and more loyal customers, price management and the promotion of cross-selling. As a result, the loan book was down by 31.4%, while gross income only fell by 17.9%. NPA still barely exist, and the greater loan-loss provisions compared to the previous year have resulted in increased coverage.