Net fees and commissions generated in 2010 increased by 2.4% year-on-year to €4,537m. This is considered positive, taking into account the reduction applied to a large number of customers in Spain, whose loyalty has increased, and the negative effect of regulatory limitations that entered into force in some countries in the Americas. Especially noteworthy are the increases in fees and commissions from pension funds, which are up 8.0%. Those corresponding to banking services were also above 2009 levels thanks to brokerage and contingent liability fees. By geographical area, the Americas increased the weight of their contribution to fees and commission income for the Group, and account for 63% of the total (60% in 2009).

The contribution of NTI was very positive over the year, with a rise of 22.7% on the amount for 2009 to €1,894m. This is because of its strong performance in the first nine months of 2010. It is worth highlighting the good result from the effect of the devaluation of the bolivar on some of BBVA Banco Provincial’s positions and the ALCO portfolios, mainly in the first half of the year.

Income from dividends came to €529m, for a year-on-year increase of 19.3%. Their main component is BBVA’s investment in Telefónica, which has increased from €1.00 to €1.30 per share.

Furthermore, equity-accounted income reached €335m, due primarily to the contribution of CNCB. This is up from the 2009 figure of €120m and is explained by the improved CNCB results along with the increase in this investment (from 10% to 15%).

The heading other operating income and expenses totaled €295m, as compared to the €248m from 2009 due to the greater contribution of the insurance business.

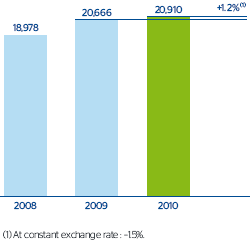

Therefore, the gross income accumulated as of December reached a Group record of €20,910m, which is 1.2% more than in the same period of 2009. This further demonstrates BBVA’s capacity for generating operating income in a still complex economic context.