Asset Management

Asset Management is BBVA’s asset management provider. It designs and manages mutual funds, pension funds and the third-party fund platform Quality Funds. The unit has solutions tailored for each customer segment, based on constant product innovation as the key to success.

In most of the markets in which it is present, BBVA has strong asset management franchises with significant market shares. Among them are Mexico (22.3%), Peru (21.3%), Argentina (7.9%), Colombia (6.2%) and Chile (4.6%), all of them as of December 31, 2010. At year-end, the managed funds had year-on-year growth of 44.3% in Mexico, 22.6% in Colombia and 12.7% in Peru.

As of 31-Dec-2010, the total assets under management in Spain were €40,519m. Mutual funds account for €23,708m of this figure, a year-on-year decrease of 28.0%, due partly to the long maturities of some funds, and also to the preference of customers for other products such as bank term deposits.

The main decrease was produced in short-term assets in fixed-income and money funds. Assets under management in pension funds in Spain were up 2.1% year-on-year to €16,811m. Of this amount, individual private plans account for €9,647m and employee and associate schemes, €7,164m. BBVA continues to be leader in pension plans as a whole, with a market share of 18.3%. Its share in employee schemes is 22.4% and in individual private plans 16.1% (Source: Inverco, data as of December 2010).

In asset management there has been a growing commitment to socially responsibly investment (SRI), which includes new extra-financial, environmental, social, ethical and corporate governance variables (ESG variables) into management, with the aim of obtaining greater returns on portfolios through a correct management of ESG risks. In fact, the employment pension scheme for people working for BBVA (worth over €2,500m) is entirely managed under SRI criteria.

Industrial and Real Estate Holdings

This unit diversifies the area’s businesses with the aim of creating value in the medium and long terms through the active management of a portfolio of industrial holdings and private equity, international and real estate funds. The management fundamentals are profitability, asset turnover, liquidity and optimal use of economic capital.

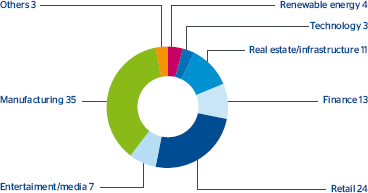

Currently, it manages a portfolio of holdings in more than 50 companies from a wide variety of sectors. Among them are Corporación IBV, Bolsas y Mercados Españoles (BME), Técnicas Reunidas, Tubos Reunidos, Desarrollo Urbanístico Chamartín, the international funds Darby Latin American Private Equity Fund L.P. and Palladium Equity Partners III L.L.C. and CITIC Capital China Real Estates Fund III.

Investments were made in equity holdings for €47m in 2010, and sales of minor stakes of portfolio holdings for about €30m.

Asia

The wholesale business in Asia performed excellently in 2010 and continues to be the basis for organic growth in the region. The loan book was 13.8% up on the close of 2009, with customer funds up 74.1%, supported by GM Asia. The accumulated net attributable profit up 95.6%. Over the year, BBVA has strengthened its trading capacity in the zone, with the opening of trading floor in Singapore.

In addition, the acquisition of an additional 4.93% in CNCB was made effective in April for approximately €1,000m, increasing the Group’s holding in the entity to its current 15%. BBVA is one of the few strategic international investors that has not only maintained but actually increased its position in the Chinese banking sector during the crisis. Also worth mentioning is the capital increase in CNCB of up to 2.2 new shares for 10 old ones. The board of the Chinese bank approved this increase to support the development and high rate of growth of its banking business. The bank closed an excellent year 2010, with remarkable growth rates in practically all its lines of business (as of 30-Sep-2010, the loan book was up 12.7% on the figure for 31-Dec-2009, and customer deposits were up 22.1%). Profit generation was above market expectations, with the accumulated figure to September up 47.6% year-on-year. In 2010 the collaboration agreement for pensions was also concluded with CNCB. Its aim is to take advantage of BBVA’s capacity and CNCB’s local presence to develop pension plans in China.

In India, another of the strategic markets in the Asian continent and in the sphere of retail banking, BBVA and the Bank of Baroda entered an agreement in December to create a joint company for credit cards. Once approval from the regulatory authorities has been obtained, the Group will be able to acquire a 51% share in the credit card unit of the Bank of Baroda, BobCards. BBVA will invest €34m in this transaction, which will also give it a strategic position in India through a leading and prestigious bank that has a network of 3,100 branches and 36 million customers.