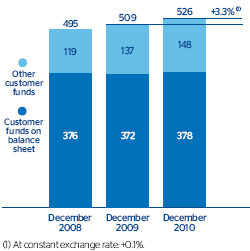

As of December 31, 2010, total customer funds came to €526 billion, an increase of 3.3% on last year’s figure. Excluding the exchange-rate effect, the increase is 0.1% year-on-year.

The item that is performing best is on-balance sheet customer funds, which amounted to €378 billion, a year-on-year growth of 1.7%. This improvement is based, once more, on the strength of customer deposits (+8.5% year-on-year to €276 billion). In the domestic sector, there was an outstanding performance in time deposits (+€14 billion over the year), with an increase of 39.9%, although this represented a slowdown on its growth in the last part of the year (+3.3% since September 2010). With respect to non-domestic deposits, the greatest increase over 2010 as a whole was once more in the items with lowest associated cost, such as current and savings accounts (+17.2% year-on-year). In contrast, time deposits continue to decrease (–30.1% year-on-year).

The performance of Group’s customer lending and deposits has kept the customer deposit/ gross customer lending ratio high, at 79.2%, which is above the figure for the previous year (76.5%).

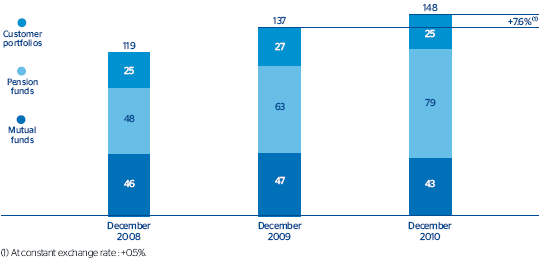

Off-balance sheet customer funds (mutual funds, pension funds and customer portfolios) amounted to €148 billion at the close of 2010, 7.6% up on the figure for 31-Dec-2009 (+0.5% at constant exchange rates). In Spain, the figure is €54 billion, a fall of 14.8% year-on-year. Of these, mutual funds amount to €24 billion and their 28.0% fall is the result of savers showing greater preference for other products such as time deposits, as well as the negative effect of the stock market prices on managed funds. The biggest falls continued to be in funds with lowest added value (guaranteed, short-term fixed-income, money-market and long-term fixed-income). Pension funds have performed better. They only fell back by 2.1% year-on-year to €17 billion. Thus, BBVA maintains its leading position as pension fund manager in Spain, with a market share of 18.3%. Finally, customer portfolios increased by 2.1% on the previous year to €13 billion.

Off-balance-sheet funds in the rest of the world totaled €94 billion, 26.8% above the figure for 31-Dec-2009 (up 12.1% at constant exchange rates). This rise can be explained both by the good performance of the pension business (up 34.6% year-on-year) in countries in which the Group has pension managers, and by increases in investment companies and funds, which increased by 36.0%. In contrast, customer portfolios continued to fall. They were down 10.0% and now stand at €12 billion.