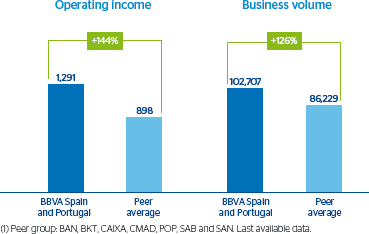

Spain and Portugal closed 2010 with clear competitive advantages as compared to the system in terms of performance, efficiency, market shares and recurrent profits. This has consolidated its leadership position in the main customer segments and consolidated it as the benchmark franchise in Spain.

These positive results can be attributed to the continuity of the anticipation strategy followed in recent years, which has also enabled its privileged positioning for addressing the new economic environment of coming years.

Also, the area established some very clear some very clear management priorities in 2010:

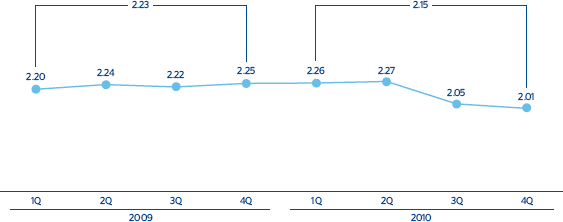

- Price management, in order to maintain the spreads and return on assets.

- Control of expenditure, which has resulted in improved productivity level.

- Attracting more customers, by taking advantage of the opportunities from the financial system restructuring process, the great growth potential offered by the high level of BBVA’s penetration in companies and by optimizing the capillarity among commercial networks through the Synergy Plan between CBB-Private Banking and CBB-Commercial Banking.

- Customer loyalty. The Spain and Portugal area has two particular management skills that are widely renowned in the market. On the one hand, its network management, which today allows the distribution structure of BBVA in Spain to be efficient, productive, adapted to its size and, above all, close to its customers. And on the other hand, its risk management, focused on continuous anticipatory efforts and control of potential nonperforming loans on a more decentralized management plan that is closer to the territory and on the execution of a management plan for the exits of foreclosed assets. The above facilitates the area’s ability to take on the future with greater assurance for success.

Spain and Portugal, in order to achieve profitable and sustainable growth, launched the Plan Uno at the beginning of 2010. This marked a very significant advance in the area’s commercial strategy to put customer focus at the center of the organization. This will be done through an important technological platform. In this regard, BBVA aspires to be its customers’ top financial supplier, and works to achieve a three-fold objective to do so: increase the service quality offered and received; increase the degree of customer loyalty and to provide its customer base with tailor-made products and services that meet their financial and non-financial needs. In addition to an excellent human team, the area has several very advanced tools in place for offering the best solutions to meet these objectives.

The area is working towards a total adaptation to the customer in all aspects of the client relationship. This will continue to be one of the area’s management priorities for 2011, during which progress will also be made in the following aspects:

- Personalized management, based on an understanding of the customer and on the technological platform. To this effect, new business protocols will be implemented and powerful consultant support management tools will be developed.

- Personalized customer solutions, which encourage and incentivize loyalty.

- Channels for customer convenience with the option of customization. Their purpose would be to increase speed and simplicity, and new channels are being implemented, such as: mobile phone banking (bbva. mobi), modern, user-friendly, personalized ATMs and a simpler, clearer, and more personalized website (bbva.es) launched in March 2010.