Despite the crisis scenario forming the backdrop to economic activity, the business model, geographical and portfolio diversification and the prudential policy applied by the Group’s risk management have stabilized the main indicators of asset quality in 2010, whose strong performance has allowed BBVA to continue outperforming the industry average.

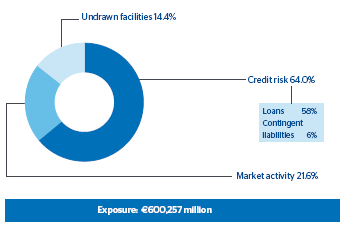

BBVA’s maximum exposure to credit risk stood at €600,257m as of December 31, 2010, a rise of 2.4% compared with the end of 2009. Customer credit risks (including contingent liabilities), which account for 64.0%, increased 5.3% over December 2009. This was due, in part, to the appreciation of the currencies against the euro which affected the Group’s balance sheet and business, but also to the real growth in lending (which rose 2.8% at constant exchange rates).

Potential exposure to credit risk in market activities (21.6% overall), including potential exposure to derivatives (including netting and collateral agreements), fell 5.2% due to fixed-income exposure, while undrawn facilities (14.4% overall) rose by 2.2%.

The business areas distribution of credit risk shows that the Americas have gained in weight, by more than nine percentage points over the year. Overall, the Americas account for 35.1% of Group’s overall credit risk, compared with 25.7% at the close of 2009. Mexico stands out, contributing to more than half of the Americas’ increase in weight.

A breakdown of customer loans by sector at year-end 2010 is given in the enclosed table. In that regard, the loan-book in the private residents sector in Spain stood at €186 billion, and the risks were highly diversified by sector and counterparty type.

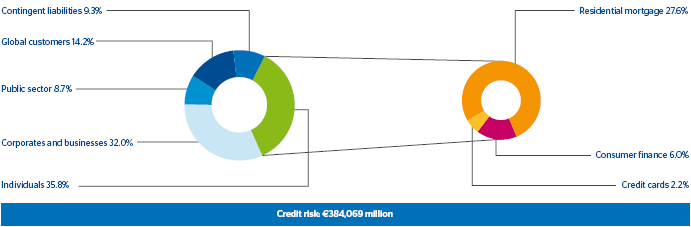

The distribution by portfolio shows that individuals’ risk accounts for 35,8% of total credit risk, residential mortgages being particularly important (27,6% overall, compared with 27% in December 2009). The LTV of this portfolio is at similar levels to December 2009, at around 53.1%. In Spain, the LTV fell to 51%.

The vast majority of the operations are for the purchase of a principal residence home (95%).

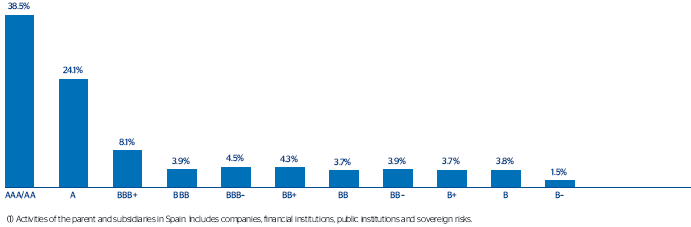

The breakdown by rating of exposure of the parent and subsidiaries in Spain, includes companies, financial institutions, public institutions and sovereign risks shows 62.6% of A or betterratings. The breakdown by rating of the business and developer segment for the parent and subsidiaries in Spain is also shown.

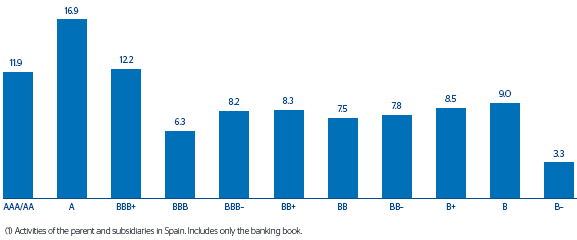

The breakdown of the loan-book by rating in Mexico with corporates and financial institutions is shown in Chart 24.