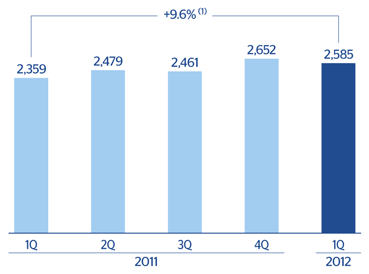

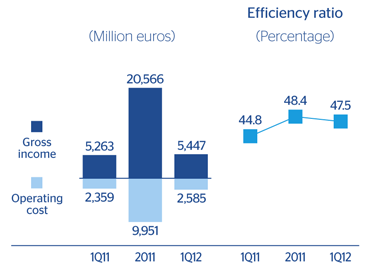

Between January and March 2012, operating expenses amounted to €2,585m. In other words, they have slowed their year-on-year increase to 9.6% (around 11% up in the first and fourth quarter of 2011). This is because the greater investment effort was made in previous quarters, basically in the emerging geographical areas. The above factors, combined with the good performance of mainly recurring revenue, meant that the efficiency ratio remained stable at 47.5% in the first quarter compared with 48.4% in 2011, and is still one of the lowest in the sector at a global level.

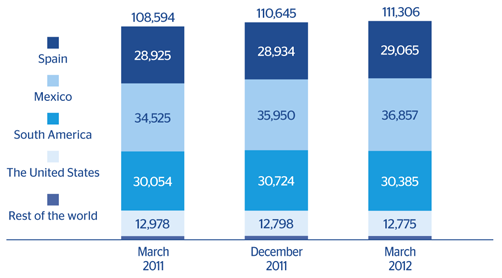

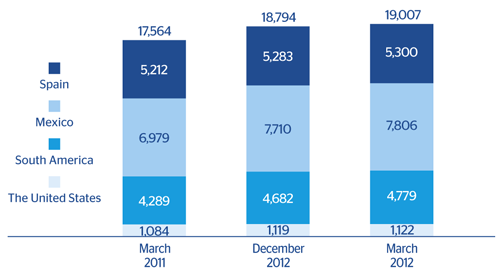

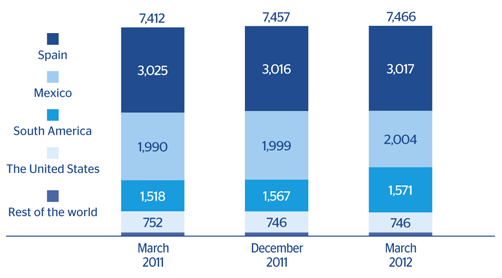

Personnel expenses were down 1.8% on the fourth quarter of 2011, despite the slight increase in the number of employees in the quarter (up 0.6% to 111,306 people). The number of branches was up slightly from 7,457 at the close of December 2011 to 7,466, due to the increased numbers in Mexico and South America. The biggest increase in terms of units is once more in ATMs, at 213 more over the quarter to 19,007. The effort made by the Bank in unit numbers and in technology continues to be notable, as ATMs are considered one of the differentiating elements in its multichannel strategy.

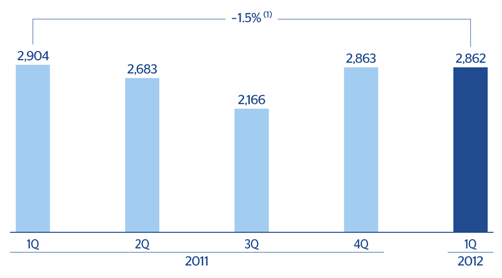

To sum up, the quarterly operating income amounted to €2,862m and shows a high resilience when compared with the first quarter of 2011 (€2,904m) and the fourth quarter of 2011 (€2,863m). This recurring and resilient generation of operating income has laid sound foundations that will enable the Bank to absorb comfortably the provisions it must make for additional deterioration in the value of its real estate assets.