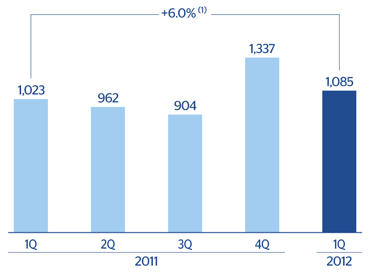

Impairment losses on financial assets were stable in the Group at €1,085m at the close of the first quarter. The higher volume in Spain (due to the current economic situation) was offset by a lower amount in the United States and South America (due to the continued improvement in the loan book) and a stable evolution in Mexico. The indicators of credit quality, risk premium, NPA ratio and coverage ratio remain stable at the same levels as the last two years.

Provisions amounted to €131m, a year-on-year fall of 12.9% (down 28.2% over the quarter). They basically cover early retirement, other allocations to pension funds and transfers to provisions for contingent liabilities.

Finally, the heading other gains (losses) reported a negative €222m (–€71m in the first quarter of 2011). It includes the provisions made for real estate and foreclosed or acquired assets in Spain.