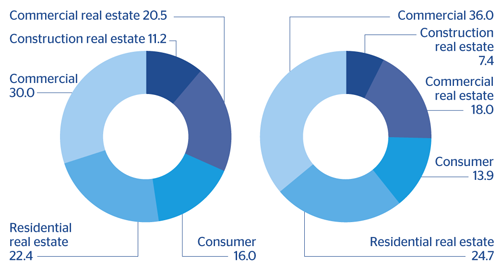

At the close of March 2012, this area’s loan book totaled €40,287m, 0.6% down quarter-on-quarter. BBVA Compass, which accounts for 79.5% of loans in the United States, posted positive quarter-on-quarter figures for the majority of loan categories in the target portfolios: up 6.0% in commercial loans and up 3.4% in residential real estate. Construction real estate and developer loans continue to fall (down 6.4% quarter-on-quarter).

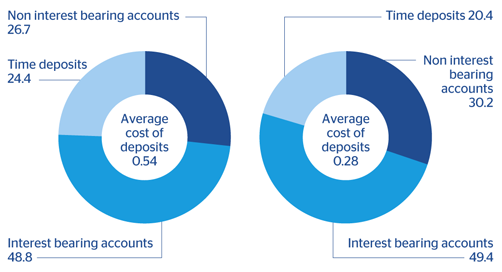

Customer deposits posted a sound 4.3% increase over the quarter. BBVA Compass had €34,343m of customer funds at the close of March 2012, up 4.7% over the quarter. Non-interest-bearing deposits (current and savings accounts) contributed to much of this increase, 6.0% up compared with the last quarter of 2011. Time deposits remained relatively stable compared with the previous quarter, but when compared with the first quarter of 2011, they were down 14.7%, as BBVA Compass continues to work to lower deposit costs.