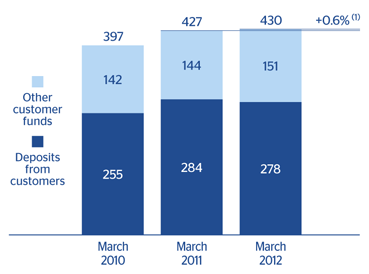

As of 31-Mar-2012 total customer funds amounted to €430 billion, with only slight year-on-year and quarter-on-quarter increases of 0.6% and 0.8%, respectively.

On-balance sheet customer funds were down 1.8% year-on-year to €278 billion. This decrease resulted from the reduction of time deposits both in the domestic sector (less need for deposit gathering, issuance of promissory notes and prioritization of price management) and the non-domestic sector (focus on lower-cost customer funds). However, current and savings accounts increased in all geographical areas, with a special emphasis on the non-domestic sector. This performance has a positive impact on both the composition of the liabilities and the reduction of their cost. The declining performance during the quarter is explained by the swap of collateralized financing instruments from short term to long term due to the three year ECB auction.

Off-balance-sheet customer funds were up 5.4% over the year and 4.9% over the quarter to €151 billion as of 31-Mar-2012. This growth was attained thanks to the improved performance of the markets in the first three months of 2012, which has had a favorable impact above all on the assets under management in pension funds (up 11.7% in the year and 7.9% in the quarter). Pension funds were up in the rest of the world (14.1% year-on-year and 9.5% over the quarter) and, to a lesser extent, in Spain (3.2% year-on-year and 2.1% over the quarter). In contrast, mutual funds fell 3.1% over the last 12 months, despite their improved performance over the quarter (up 2.2%). Their overall decrease can be explained by the reduction in Spain, though the assets under management in this country showed greater stability in the last quarter. In the rest of the world, mutual funds rose 4.4% on the figure for 31-Mar-2011 and 3.6% on the close of 2011.