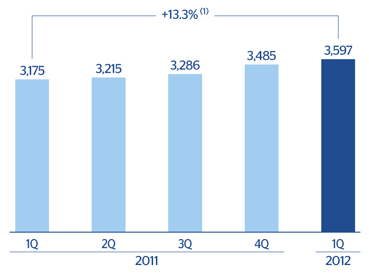

The Group’s cumulative net interest income through March 2012 amounted to €3,597m. This is a rise of 3.2% on the figure for the previous quarter and 13.3% compared with the same period the previous year. There was a rise in practically all the geographical areas. In the euro zone this rise is the result of lower finance costs, resulting, basically from the ECB liquidity auctions. In The Americas the improvement was the result of the excellent handling of spreads and the positive trend in activity. Finally, there is the effect from the change in perimeter due to the acquisition of Garanti in March 2011 that adds 4 percentual points to the growth.

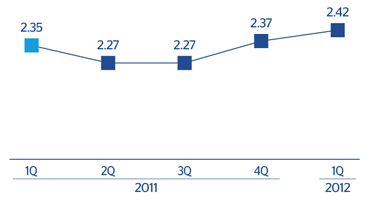

With respect to spreads over the quarter:

- Customer spread in the euro area was up 19 basis points to 2.14%. The yield on loans was maintained (down 2 basis points to 3.52%) in an environment of falling interest rates. At the same time, the cost of funds fell 21 basis points to 1.39%, as the ECB auction mentioned above have, among other effects, reduced the competition for attracting liability products in the sector.

- In Mexico interest rates continue flat and are expected to remain so for the whole year. Despite this, the positive performance in new production consumer finance and credit cards within the retail portfolio compensates partially this environment and brings the yield on loans in the area down only 10 basis points to 13.18%. The cost of deposits fell 18 points and closed March 2012 at 1.65%. As a result, customer spread improved by 8 basis points to 11.53%, while net interest income in Mexico was up 9.4% on the first quarter of 2011 at constant exchange rates.

- In South America, the year-on-year increase in the net interest income (+29.9%) at constant exchange rates can be explained by the strength of activity and by the excellent price management in a highly competitive environment.

- In the United States, BBVA Compass spreads continue to improve, despite the current interest-rate environment, thanks to favorable price management. As a result, the net interest income remained similar to previous quarters (–1.7% over the quarter and –3.0% in the last 12 months, at constant exchange rates).