In the first quarter of 2012 this area generated a profit of €299m, above the average for the last three quarters (in which Garanti already contributed throughout the period) and slightly below the profit reported in the fourth quarter, which was unusually high.

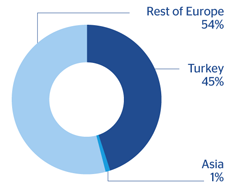

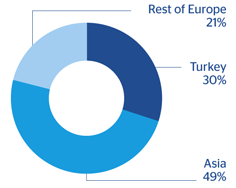

The net attributable profit in Europe (excluding Garanti) totaled €64m, 21% of the area’s profit, and shows high resilience despite the difficult situation in which it was generated, with a year-on-year fall of only 6.5%, but a 33.1% increase in the quarter. The positive evolution of fee income and loan-loss provisions over the last twelve months, together with cost control, partly offset the lower net interest income and explain this result.

Asia accounts for 49% of the area’s profit and generated €147m in this quarter. This 25.3% year-on-year increase was due to the growing contribution of CNCB. The Chinese bank made €3,660m in 2011, 43% more than in 2010, and is the seventh bank in the country in terms of assets. These good results can be explained by the increase in activity, with the loan book growing at an average annual rate of 13% and customer deposits rising by 14%, according to 2011 year-end data. This boosted the positive performance of the bank’s income, particularly net interest income and fee income.

BBVA’s presence in Asia through its Chinese partner is complemented by the other markets where the Bank operates through five representative offices (Beijing, Shanghai, Mumbai, Sydney and Abu Dhabi, this last one opened recently) and five branches (Seoul, Taipei, Hong Kong, Singapore and Tokyo). In short, BBVA is the only European bank leader in Latin America and with full operational capacity in the Asia-Pacific region.

Finally, Garanti contributes with €88m of profit, i.e. 30% of the total figure for the area.

The most notable aspects regarding Garanti Bank in the quarter are summarized below:

- In terms of business activity, the Turkish bank is giving priority to selective growth of the loan book to improve the position in high profitability products. It has increased its market share in mortgages and personal loans, while reducing the volume in loans to companies, a segment in which the yield on loans remains high. On the liabilities side, focus was set on more stable and lower-cost sources of finance. Therefore, there was a rise in deposits in lira, which in turn has avoided the price competition existing in deposits in other currencies and, as a result, the cost of deposits has improved.

- As for asset quality, Garanti Bank closed the period with a NPA ratio lower than that of the sector (1.9% compared to 2.7%). The slight rise in the NPA ratio in the quarter was due to credit cards and personal loans, in line with the sector trend.

- As for earnings, one notable aspect is the increased revenue diversification and higher fee income, despite the regulatory limitations that came into effect recently. To sum up, Garanti generated net attributable profit of €366m in the first quarter of the year (€407m for the banking group).