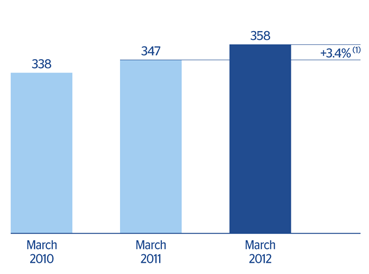

As of 31-Mar-2012, gross customer lending closed at €358 billion, with a 3.4% year-on-year rise, but a slight 0.8% fall on the previous quarter.

By business areas, the geographic disparity of recent quarters continues:

- In South America, lending continues to grow significantly (up 24.2% year-on-year at constant exchange rates). This is the result of its excellent performance in practically all countries in the region, in which retail portfolios are extremely buoyant.

- In Mexico, lending grew 7.5% over the same period (also at constant exchange rates). It is worth noting the significant increase in the most profitable segments, such as loans to small businesses, consumer finance and credit cards.

- In the United States, lending has been flat over the last year (down 0.6%) as a result of decreased exposure to the developer sector. On the other hand, the target portfolios (commercial and residential real estate) continue to increase, leading to a new improvement in the loan-book mix and, therefore, of the area’s asset quality.

- Lending in Eurasia was up 2.2% thanks to the positive contribution from Garanti.

- Finally, lending fell 1.7% in Spain due to the abovementioned financial deleveraging process, which picked up speed in the first quarter of 2012.

To conclude, the domestic sector fell back 2.0% over the last twelve months, with generalized decreases in practically all portfolios, especially those linked to the companies sector. However, the non-domestic sector grew strongly (up 10.8% year-on-year).

Finally, non-performing loans have remained stable since December 2009.