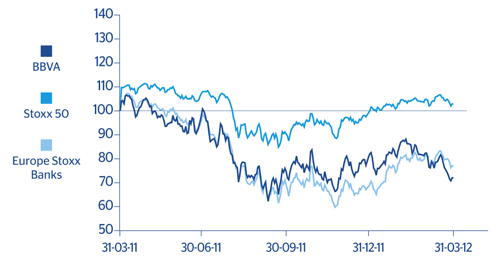

In the first quarter of 2012 the market has focused much of its attention on the liquidity injections by the ECB designed to ease pressure on European financial institutions. These measures appear to have been favorably received: they have pushed the Stoxx Banks index of the European banking sector up 12.7% since the end of the year, compared with the modest rise in the general equity market index for the same period (Stoxx 50: +3.8%). However, uncertainty around the macroeconomic environment in Europe has not dissipated, and the underlying risk in peripheral countries appears to remain, despite the reform processes announced in some of them, such as Spain.

BBVA’s results for the fourth quarter of 2011 have once more showed its ability to increase revenue in the different geographical areas in which it operates. Analysts have highlighted the Group’s outstanding recurrent and organic generation of earnings over the quarter. Other notable factors have been the stabilization of net interest income in Spain, the resilience of credit quality and the capacity to absorb the new provisioning requirements for real-estate. Of particular note once more has been the quality of the results from Mexico. There has also been a favorable surprise in the profits from South America and Eurasia. BBVA’s position in terms of capital and liquidity continues to be very sound. This is very positively valued by the market, as it shows the Group’s ability to adapt to the increasingly demanding regulatory environment and maintain a stable dividend policy.

Against this backdrop, the BBVA share lost 10.7% over the quarter to €5.97 per share, with a market capitalization of €29,257m. This represents a price/book value ratio of 0.7, a P/E (calculated on the average profit for 2012 estimated by the consensus of Bloomberg analysts) of 7.1 and a dividend yield (also calculated according to the average dividend per share estimated by analysts for 2012 compared with the share price at March 31, 2012) of 7.0%. The drop experienced by BBVA was greater than that of the Ibex 35 index (down 6.5%) and contrasts with the trend in the European banking sector as a whole (Stoxx Banks up 12.7% and Euro Stoxx Banks up 7.6%), but in line with the overall figure for the banks that are traded on the Spanish stock market. This is because the uncertainty associated with sovereign risk appears to have influenced the sector in Spain and thus the BBVA share, which fell mainly in the second half of March.

The AGM held on March 16, 2012 and with a 64.5% participation, approved a final dividend of €0.12 per share, so total shareholder remuneration for 2011 amounts to €0.42 per share, the same amount as last year. This payment of €0.12 per share forms part of the system of flexible remuneration called the “Dividend Option.”

Finally, the new ordinary BBVA shares issued to cover the voluntary conversion on March 30 of Mandatory Subordinated Bonds issued last December began trading on April 4. The conversion reached 27.84% of the total amount of the Convertible Bond issue at a price of €6.047 per share, determined by the arithmetic mean of the closing prices of BBVA share over the five trading days prior to the conversion.