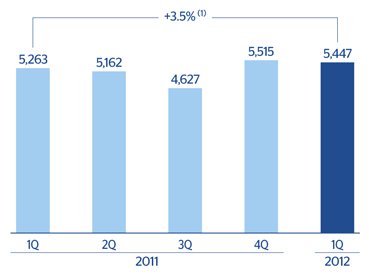

Income from fees and commissions performed positively, with a rise of 9.1% on the first quarter of 2011 to €1,216m. The expansion of activity in emerging countries, as well as the incorporation of Garanti, contributed very significantly to this result. It is worth noting that this good result came despite the coming into force in 2011 of regulatory limitations in some geographical areas and the economic weakness in developed countries.

NTI totaled €367m, a fall of 51.2% on the excellent first quarter of 2011, when the sales and valuations of some positions led to significant gains. Compared to the fourth quarter of 2011, NTI was down by 11.6%, due to the favorable interest-rate hedging operations recorded in the last three months of 2011.

The excellent results from CNCB have boosted the good performance of income by the equity method. This heading totals €193m, slightly down on the fourth quarter of 2011, but a year-on-year rise of 60.1%.

At €47m, the other operating income and expenses heading is similar to the figure reported in the fourth quarter of 2011, but a year-on-year fall if compared with the €79m of the first quarter of last year. Its main components were net income from the insurance business, which was up 9.4% over the same period, and the contributions to the different deposit guarantee funds, which increased a considerable 48.7% on the first quarter of 2011.

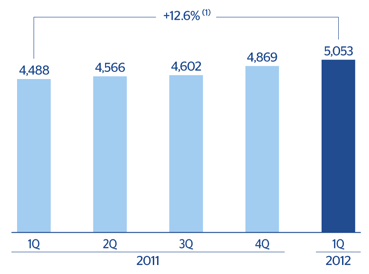

In conclusion, recurring revenue (net interest income plus income from fees and commissions) has grown quarter by quarter to €4,812m in the first quarter of this year and now accounts for 88.4% of gross income (81.5% 12 months earlier). Other revenue fell back 34.9% year-on-year due to the extraordinarily high NTI in the first quarter of 2011 and the increased current contributions to the different deposit guarantee funds. Both these elements are not offset by either the good performance in the insurance business or the growing contribution from CNCB. As a result, gross income amounted to €5,447m, a year-on-year increase of 3.5%.