Capital & Treasury stock Information

Capital stock

As of December 23rd 2025, the share capital of BBVA is of €2,797,394,663 divided into 5,708,968,700 fully subscribed and paid-up registered shares, all of the same class and series, represented through book-entry accounts (5,708,968,700 voting rights).

All BBVA shares carry the same voting and dividend rights and no single stockholder enjoys special voting rights. BBVA shares are traded on the continuous market in Spain, as well as on the London and Mexico stock markets. American Depositary Shares (ADSs) are listed in New York.

Capital issuance

For a full description of how BBVA’s share capital has developed since 2000, please see the table below, which presents a full account of share transactions as the company expanded and acquired other financial institutions.

Capital issuance

| Date | Transaction | Nominal value, € | Number of new shares | Total number of shares outstanding | Price, € |

|---|---|---|---|---|---|

| 12/23/25 | Share capital reduction | 0.49 | -54,316,765 | 5,708,968,700 | |

| 05/24/24 | Share capital reduction | 0.49 | -74,654,915 | 5,763,285,465 | |

| 12/19/23 | Share capital reduction | 0.49 | -127,532,625 | 5,837,940,380 | |

| 06/02/23 | Share capital reduction | 0.49 | -64,643,559 | 5,965,473,005 | |

| 09/30/22 | Share capital reduction | 0.49 | -356,551,306 | 6,030,116,564 | |

| 06/15/22 | Share capital reduction | 0.49 | -281,218,710 | 6,386,667,870 | |

| 04/24/17 | Dividend Capital increase | 0.49 | 101,271,338 | 6,667,886,580 | |

| 10/20/16 | Dividend Capital increase | 0.49 | 86.257.317 | 6.566.615.242 | |

| 04/19/16 | Dividend Capital increase | 0.49 | 113.677.807 | 6.480.357.925 | |

| 10/19/15 | Ampliación dividendo opción | 0.49 | 61.442,106 | 6.366.680.118 | |

| 04/14/15 | Dividend Capital increase | 0.49 | 80.314.074 | 6.305.238.012 | |

| 01/07/15 | Dividend Capital increase | 0.49 | 53.584.943 | 6.224.923.938 | |

| 11/20/14 | Capital increase | 0.49 | 242.424.244 | 6.171.338.995 | 8,25 |

| 10/13/14 | Dividend Capital increase | 0.49 | 41.746.041 | 5.928.914.751 | |

| 04/14/14 | Dividend Capital increase | 0.49 | 101.214.267 | 5.887.168.710 | |

| 10/23/13 | Dividend Capital increase | 0.49 | 61.627.952 | 5.785.954.443 | |

| 07/05/13 | Conversion of convertible bonds | 0.49 | 192.083.232 | 5.724.326.491 | |

| 04/22/13 | Dividend Capital increase | 0.49 | 83.393.714 | 5.532.243.259 | |

| 10/24/12 | Dividend Capital increase | 0.49 | 66.741.405 | 5.448.849.545 | |

| 10/16/12 | Supplement Preferred secuirities Unnim | N.A | N.A | 5.382.108.140 | Supplement |

| 09/28/12 | Preferred Shares Offer (Unnim) | N.A. | 0 | 5.382.108.140 | Note (Spanish) |

| 07/04/12 | Conversion of convertible bonds | 0.49 | 238.682.213 | 5.382.108.140 | - |

| 05/08/12 | Scrip issue, dividend option | 0.49 | 82.343.549 | 5.143.425.927 | - |

| 04/02/12 | Conversion of convertible bonds | 157.875.375 | 5.061.082.378 | ||

| 10/25/11 | Scrip issue, dividend option | 0.49 | 78.413.506 | 4.903.207.003 | - |

| 07/18/11 | Conversion of convertible bonds | 0.49 | 273.190.927 | 4.824.793.497 | - |

| 04/27/11 | Scrip issue of shares | 0.49 | 60.694.285 | 4.551.602.570 | 8,966 (Ref.) |

| 11/30/10 | Issue of new shares | 0.49 | 742.939.164 | 4.490.908.285 | 6,75 |

| 09/10/07 | Issue of new shares | 0.49 | 196.000.000 | 3.747.969.121 | 16,77 |

| 11/28/06 | Issue of new shares | 0.49 | 161.117.078 | 3.551.969.121 | 18,62 |

| 03/04/04 | Issue of 6,1%, buy-out of minority shareholders in BBVA Bancomer | 0.49 | 195.000.000 | 3.390.852.043 | 10,25 |

| 11/30/00 | Issue of 1,3% | 0.49 | 41.049.917 | 3.195.852.043 | 13,85 |

| 10/31/00 | Issue of 0,06695% | 0.49 | 2.110.770 | 3.154.802.126 | 13,85 |

| 09/08/00 | Issue of 0,00259% for Banco del Comercio and Banco de Negocios Argentaria | 0.49 | 81.776 | 3.152.691.356 | BdC: 46,451, BNA: 27,769 |

| 07/31/00 | Issue of 0,00147 % | 0.49 | 46.481 | 3.152.609.580 | 13,85 |

| 06/09/00 | Issue of 0,0617% for Banca Catalana and Banco de Alicante | 0.49 | 1.943.468 | 3.152.563.099 | B.C: 5,42, B.A: 4,50 |

| 06/06/00 | Green shoe, international allotment | 0.49 | 20.000.000 | 3.150.619.631 | 13,84 |

| 05/31/00 | Issue of 0,0007% | 0.49 | 21.569 | 3.130.619.631 | 13,85 |

| 05/23/00 | Issue of new shares for the purchase of Bancomer and Internet | 0.49 | 200.000.000 | 3.130.598.062 | Inst: 13,84, Min: 13,61 |

| 04/24/00 | Reduction of nominal value by 0.03 euros | 0.49 | 0 | 2.930.598.062 | - |

| 03/31/00 | Issue of 0,002% | 0.52 | 58.328 | 2.930.598.062 | 13,85 |

| 03/31/00 | Issue of 0,001% | 0.52 | 25.155 | 2.930.539.734 | 4,60 |

| 01/28/00 | Issue at the merger with Argentaria (exchange of 5 BBV shares for 3 in Argentaria) | 0.52 | 817.279.573 | 2.930.514.579 | 2,97 |

Shareholder struct.

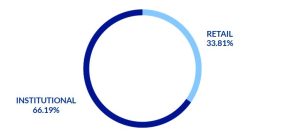

On September 30, 2025, the number of BBVA shares outstanding was 5,763,285,465. The number of shareholders reached 669,979 and, by type of investor, 66.19% of the capital belonged to institutional investors and the remaining 33.81% was in the hands of retail shareholders.

Shareholder structure (10-30-2025)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 297,411 | 44.4 | 53,650,054 | 0.9 |

| 501 to 5,000 | 292,809 | 43.7 | 517,736,617 | 9.0 |

| 5,001 to 10,000 | 42,889 | 6.4 | 300,497,617 | 5.2 |

| 10,001 to 50,000 | 33,243 | 5.0 | 637,361,459 | 11.1 |

| 50,001 to 100,000 | 2,345 | 0.4 | 160,403,640 | 2.8 |

| 100,001 to 500,000 | 1,028 | 0.2 | 182,392,714 | 3.2 |

| More than 500,001 | 254 | 0.04 | 3,911,243,364 | 67.9 |

| Total | 669,979 | 100 | 5,763,285,465 | 100 |

Shareholdings & Treasury stock

Information disclosures in the public records about Major Holdings in BBVA´s share capital.

Through the links provided below, you can access information shown in the public records of the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores or CNMV) on Major Holdings in BBVA´s share capital, Significant Shareholdings held by the Bank in other listed companies and the Bank´s treasury stock.

- Major Holdings in BBVA´s share capital

- Significant Shareholdings in other listed companies

- Treasury Stock

Information on BBVA’s discretionary treasure share trading activity.

Guidelines of BBVA on its discretionary treasury share trading activity

- Communication of Information related to discretionary treasury stock operations during 4Q25

- Communication of Information related to discretionary treasury stock operations during 3Q25

- Communication of Information related to discretionary treasury stock operations during 2Q25

- Communication of Information related to discretionary treasury stock operations during 1Q25

- Communication of Information related to discretionary treasury stock operations during 4Q24

- Communication of information related to discretionary treasury stock operations during 3Q24

- Communication of information related to discretionary treasury stock operations during 2Q24

- Communication of information related to discretionary treasury stock operations during 1Q24

- Communication of information related to discretionary treasury stock operations during 4Q23

- Communication of information related to discretionary treasury stock operations during 3Q23

- Communication of information related to discretionary treasury stock operations during 2Q23

- Communication of information related to discretionary treasury stock operations during 1Q23

- Communication of information related to discretionary treasury stock operations during 4Q22

- Communication of information related to discretionary treasury stock operations during 3Q22

- Communication of information related to discretionary treasury stock operations during 2Q22

- Communication of information related to discretionary treasury stock operations during 1Q22

- Communication of information related to discretionary treasury stock operations during 4Q21

- Communication of information related to discretionary treasury stock operations during 3Q21

- Communication of information related to discretionary treasury stock operations during 2Q21

- Communication of information related to discretionary treasury stock operations during 1Q21

- Communication of information related to discretionary treasury stock operations during 4Q20 and annual volumes

- Communication of information related to discretionary treasury stock operations during 3Q20

Information disclosures in the public records about Major Holdings in BBVA´s share capital.

Through the links provided below, you can access information shown in the public records of the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores or CNMV) on Major Holdings in BBVA´s share capital, Significant Shareholdings held by the Bank in other listed companies and the Bank´s treasury stock.

- Major Holdings in BBVA´s share capital

- Significant Shareholdings in other listed companies

- Treasury Stock

Information on BBVA’s discretionary treasure share trading activity.

Guidelines of BBVA on its discretionary treasury share trading activity

- Communication of Information related to discretionary treasury stock operations during 4Q25

- Communication of Information related to discretionary treasury stock operations during 3Q25

- Communication of Information related to discretionary treasury stock operations during 2Q25

- Communication of Information related to discretionary treasury stock operations during 1Q25

- Communication of Information related to discretionary treasury stock operations during 4Q24

- Communication of information related to discretionary treasury stock operations during 3Q24

- Communication of information related to discretionary treasury stock operations during 2Q24

- Communication of information related to discretionary treasury stock operations during 1Q24

- Communication of information related to discretionary treasury stock operations during 4Q23

- Communication of information related to discretionary treasury stock operations during 3Q23

- Communication of information related to discretionary treasury stock operations during 2Q23

- Communication of information related to discretionary treasury stock operations during 1Q23

- Communication of information related to discretionary treasury stock operations during 4Q22

- Communication of information related to discretionary treasury stock operations during 3Q22

- Communication of information related to discretionary treasury stock operations during 2Q22

- Communication of information related to discretionary treasury stock operations during 1Q22

- Communication of information related to discretionary treasury stock operations during 4Q21

- Communication of information related to discretionary treasury stock operations during 3Q21

- Communication of information related to discretionary treasury stock operations during 2Q21

- Communication of information related to discretionary treasury stock operations during 1Q21

- Communication of information related to discretionary treasury stock operations during 4Q20 and annual volumes

- Communication of information related to discretionary treasury stock operations during 3Q20