Strategy: BBVA's transformation

Strategy

BBVA’s strategy is based on three global trends with a critical role in the transformation of the economy: digitization, innovation and decarbonization.

- Firstly, digitization. People’s behavior continues to move not only to digital and mobile channels, but also to large value ecosystems offered by the main technology companies with a differentiated customer experience.

- Secondly, innovation. The role of new technologies continues to play a critical function in the transformation of the economy, with a great impact on growth and productivity. A true era of opportunities thanks to the new possibilities offered by new technologies such as artificial intelligence, quantum computing, cloud processing, blockchain technology, etc.

- Lastly, decarbonization is clearly a differential trend in the current environment and the greatest disruption in history due to its strong impact on the competitive dynamics of many sectors. Innovation plays a key role in the decarbonization process, a challenge that requires strong investments in new carbon-neutral technologies in all sectors, beyond energy. This challenge is of great importance today in a context that has shown that high energy dependence can be a strong vulnerability. Energy independence has become a priority beyond the fight against climate change.

Purpose

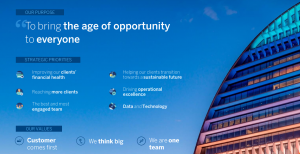

BBVA’s strategy revolves around a single Purpose: “To bring the age of opportunity to everyone”.

Thanks to innovation and technology, BBVA seeks to have a positive impact on the lives of people and on the businesses of companies, providing access to products, advice and solutions that allow its customers to make better decisions about their finances and achieve their vital and business purposes.

Values

The Group is based on solid values: customer comes first, we think big and we are one team. These values and their associated behaviors are the guide for action in all decisions made by all the people who are part of the BBVA Group and help them make the Purpose come true:

Customer comes first

BBVA places customers at the center of its activity, before anything else. The Bank aspires to take a holistic customer vision, not just financial. This means working in a way which is empathetic, agile and with integrity, among other things.

- We are empathetic: we take the customer’s viewpoint into account from the outset, putting ourselves in their shoes to better understand their needs.

- We have integrity: we always act honestly, in accordance with the law and BBVA’s rules and policies. We do not tolerate inappropriate behavior and always put the customer’s interests first.

- We meet their needs: We are swift, agile and responsive in resolving the problems and needs of our customers, overcoming any difficulties we encounter.

We think big

It is not about innovating for its own sake but instead to have a significant impact on the lives of people, enhancing their opportunities. BBVA Group is ambitious, constantly seeking to improve, not settling for doing things reasonably well, but instead seeking excellence as standard.

- We are ambitious: we set ourselves ambitious and aspirational challenges to have a real impact on people’s lives.

- We break the mold: we question everything we do to discover new ways of doing things, innovating and testing new ideas which enables us to learn.

- We amaze our customers: we seek excellence in everything we do in order to amaze our customers, creating unique experiences and solutions which exceed their expectations.

We are one team

People are what matters most to the Group. All employees are owners and share responsibility in this endeavor. We tear down silos and trust in others as we do ourselves. We are BBVA.

- I am committed: I am committed to my role and my objectives and I feel empowered and fully responsible for delivering them, working with passion and enthusiasm.

- I trust others: I trust others from the outset and work generously, collaborating and breaking down silos between areas and hierarchical barriers.

- I am BBVA: I feel ownership of BBVA. The Bank’s objectives are my own and I do everything in my power to achieve them and make our Purpose a reality.

Strategic Priorities

Guided by its Purpose and values, BBVA’s strategy is structured around six strategic priorities:

1. Improving our clients’ financial health

BBVA aspires to be its customer’s trusted financial partner, helping them to improve their financial health by offering personalized advice based on technology and the use of data.

Money management is one of the greatest concerns for people. BBVA wants to help its customers improve their financial health in two ways:

- – On the one hand, by supporting them in the day-to-day management of their finances, helping them understand and be aware of their income and expenses, management of future needs, capacity to save, etc.

– On the other hand, helping clients to make the best financial decisions to achieve their vital and business goals in the medium and long term through personalized advice.

2. Helping our clients transition toward a sustainable future

Climate change is a challenge that urgently needs to be addressed, but it is also a major business opportunity for the financial sector. The decarbonization of the economy will have an impact on all industries and on the way people move, consume or furnish their homes, requiring significant investments that will last for decades to come.

Additionally, the Bank has an opportunity in the development of inclusive growth. The current environment, with high digitization and use of data, makes it easier to provide an efficient service and with a better understanding of customer behavior. This environment allows the development of new business opportunities that favor inclusive economic development, supporting disadvantaged sectors and inclusive infrastructures, as well as mass banking leveraged on digital channels and new relationship models.

3. Reaching more clients

Scale is increasingly critical in the banking business. BBVA aims to accelerate profitable growth, supporting itself through its own channels and where the customers are (in third-party channels).

In this sense, BBVA has identified the payments, insurance, asset management and cross-border business activities of companies as key drivers of profitable growth, as well as the value segments of SMEs and private banking.

The key role of innovation in the growth of BBVA implies the Group’s firm commitment to new business models such as digital neobanks and the creation of BBVA Spark, that offers a comprehensive proposal of financial services to accompany companies innovative in its different phases of growth.

4. Driving operational excellence

BBVA is committed to providing the best experience possible and is transforming its model of customer relations to adapt to changes in customer behavior. To do so, it provides access to its products and services through simple processes. The role of the commercial network is increasingly more focused on transactions of greater added value for customers. Interactions of lower added value are redirected to self-service channels, thus reducing unit costs and increasing productivity.

The transformation of the relational model is accompanied by a change in the operational model, focused on process reengineering in the search for greater automation and improved productivity, as well as speedy delivery to the market of new products and functionalities.

This is not forgetting disciplined management of both financial and non-financial risks and optimized use of capital key factors for consistently achieving a return higher than the cost of capital.

5. The best and most engaged team

The team continues to be a strategic priority for the Group. A diverse and empowered team, with an outstanding culture, guided by the BBVA Purpose and values and driven by a model of talent development which provides growth opportunities for all.

BBVA works to promote the growth and training of the people who make up the Group, who have the necessary skills, knowledge and experience to achieve strategic objectives efficiently and effectively. Also to ensure that employees live the values and behaviors of the Group. People want to be part of companies that are inspired by purpose, with an engaging culture and values that foster diversity, inclusion, equality, social impact, and recognition of work.

6. Data and technology

Data and technology are obvious accelerators to achieve our strategy. The commitment to developing advanced data analysis capacities, together with secure and reliable technology, allows the creation of outstanding high-quality solutions that help create competitive advantages.

The use of data and new technologies also generates the opportunity for increasingly global processes which can be used in the different geographies and are easily scalable.

BBVA’s strategy is based on three global trends with a critical role in the transformation of the economy: digitization, innovation and decarbonization.

- Firstly, digitization. People’s behavior continues to move not only to digital and mobile channels, but also to large value ecosystems offered by the main technology companies with a differentiated customer experience.

- Secondly, innovation. The role of new technologies continues to play a critical function in the transformation of the economy, with a great impact on growth and productivity. A true era of opportunities thanks to the new possibilities offered by new technologies such as artificial intelligence, quantum computing, cloud processing, blockchain technology, etc.

- Lastly, decarbonization is clearly a differential trend in the current environment and the greatest disruption in history due to its strong impact on the competitive dynamics of many sectors. Innovation plays a key role in the decarbonization process, a challenge that requires strong investments in new carbon-neutral technologies in all sectors, beyond energy. This challenge is of great importance today in a context that has shown that high energy dependence can be a strong vulnerability. Energy independence has become a priority beyond the fight against climate change.