WEF-IBC and SASB Metrics

Alignment of BBVA Group's non-financial information to WEF-IBC and SASB standards

More information

For this reason, BBVA incorporates sustainability at the heart of its strategy, being, as we have previously mentioned, one of the six established strategic priorities. This strategic priority has been divided into three objectives included in BBVA’s General Sustainability Policy, which are:

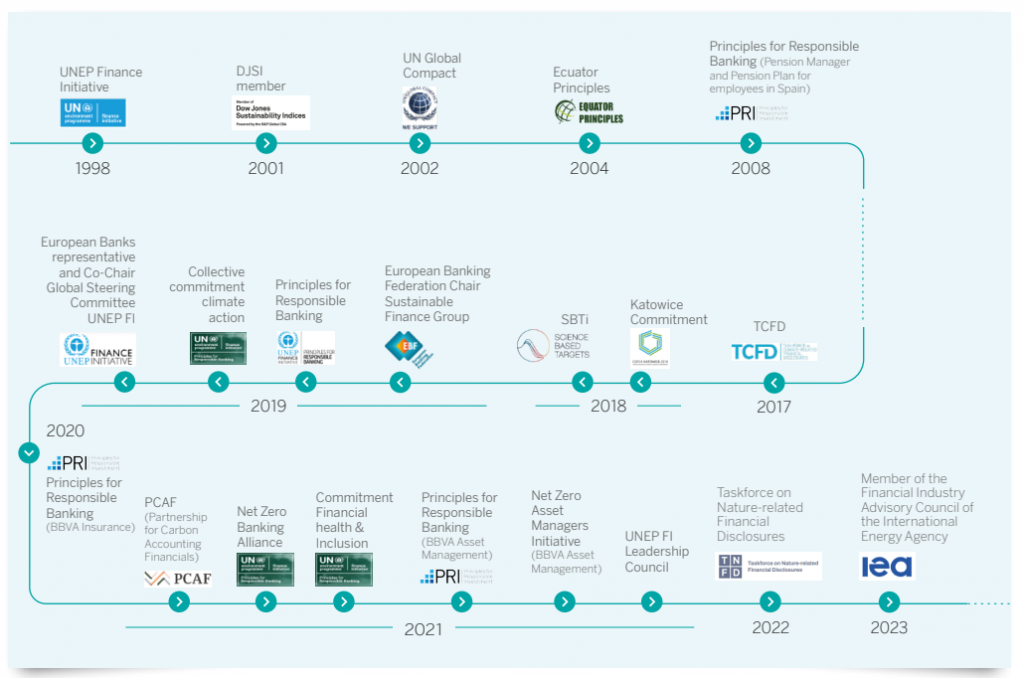

In 2018, BBVA presented its 2025 Commitment to channel €100 billion in sustainable finance by 2025 to contribute to the achievement of the SDGs and the challenges arising from the Paris Climate Agreement. Since then, the Group has advanced in the development of this priority, integrating sustainability transversally in internal management and processes and also in the relationship with customers and other stakeholders.

As of December, 2023, the bank had reached €206 billion at a pace that has pushed the bank to raise once again the goal, to €300 billion, three times its initial commitment.

BBVA is also committed to being Net Zero by 2050, not only for its direct emissions, goal already achieved since 2020, but also for indirect emissions, that is, those of the customers it finances. To achieve this goal, BBVA has committed to stop financing coal by 2030, in developed countries, and by 2040 in the rest of the geographies where it operates. In addition, BBVA has set up intermediate objectives to decarbonize its credit portfolio in some of the most carbon-intensive sectors and participates as a founding member of the Net-Zero Banking Alliance (NZBA).

BBVA presents its Community Commitment, by which €550m will be allocated between 2021 and 2025 to social initiatives supporting inclusive growth in the countries where the Group operates. This commitment is a response to the most important social challenges and aims to contribute to a sustainable and inclusive recovery.

BBVA is also committed to transparency and therefore publishes the TCFD Report, following the recommendations of the Task Force on Climate-Related Financial Disclosure sponsored by the Financial Stability Board (hereinafter, FSB). In addition, since 2020 BBVA has published additional sustainability metrics following two of the most advanced standards in the market, such as those issued by the World Economic Forum-International Business Council (hereinafter, WEFIBC) or by the Sustainability Accounting Standards Board (hereinafter SASB).

Alignment of BBVA Group's non-financial information to WEF-IBC and SASB standards

More information

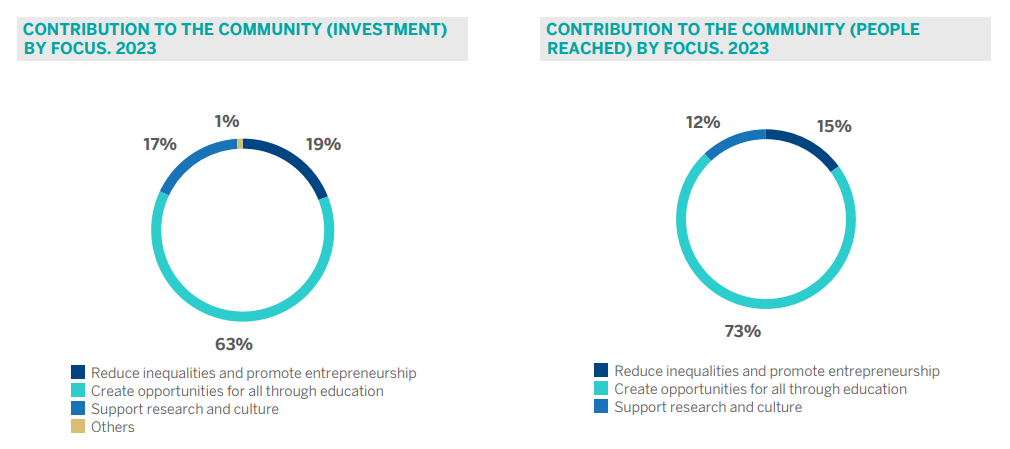

This plan is structured around three main areas of action and seeks to contribute to the fulfillment of certain Sustainable Development Goals (SDGs): reducing inequalities and promoting entrepreneurship (SDG 8 and 10), creating opportunities for all through education (SDG 4) and supporting research and culture (SDG 9 and 11).

In 2023, the BBVA Group earmarked 174 million euros for contribution to the community (131 million euros in 2022). This figure represents 2,17% of adjusted net attributable profit 79.4 million people have benefited from this contribution. In particular, among the direct beneficiaries, 3,307,147 entrepreneurs have benefited from support, 749.565 people have been trained in financial literacy and 861,023 people have participated in educational programs.

BBVA puts this community commitment into practice through its local banks and foundations, as well as supporting other foundations such as the BBVA Foundation, the BBVA Mexico Foundation and the BBVA Microfinance Foundation.

For the Board of Directors, an essential element of this strategic approach is the integration of sustainability and the fight against climate change into the Group’s activities, managing the risks associated with these areas, and considering them a great opportunity for business in which to support its growth strategy. For monitoring and supervision, the Board is assisted by its committees on matters within their respective areas of concern:

In 2021, BBVA gave fresh impetus to its strategy by elevating sustainability to the highest executive level of the organization by creating the Global Sustainability business area, with direct reporting to the CEO and the Chair.

The global strategy of the reduction of direct impacts is organized around three core elements: reduction in consumption through the energy efficiency initiatives:

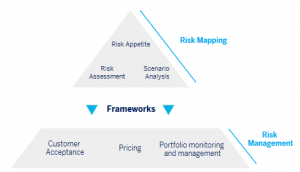

Managing indirect impacts that customers generate on the environment is part of the Pledge 2025. To manage them, BBVA has implemented a number of initiatives and tools, within environmental and Social Framework or the Equator Principles.

BBVA carries out a qualitative materiality analysis to identify those environmental, social and governance issues that are significant for the Group and its stakeholders, taking into account in the analysis the double perspective of materiality, which underlies the NFRD and Law 11/2018, as well as in the GRI guide (December 2021 version). BBVA, based on this double perspective on materiality, identifies issues related to its business that could be currently or potentially affected by sustainability issues (“outside-in” perspective also known as “financial materiality”), as well as the way in which its activities could currently or potentially affect society and the environment (“inside-out” perspective also known as “impact materiality”).

The most notable material issues in 2023 are the following:

In addition and on a voluntary basis, BBVA publishes progress in ESG disclosures, according to two metrics with a high reputation in the market:

Alignment of WEF-IBC and SASB standards

In addition to the UN Global Compact, BBVA co-chairs the UNEP FI steering committee, holds the chair of the sustainable finance working group at the European Banking Federation and is a member of the steering committee of the Equator Principles. BBVA is also a member of the Steering Group of the Net Zero Banking Alliance, the Sustainable Finance Working Group of the Institute for International Finance, the Task Force of Voluntary Carbon Markets and the Alliance of CEO Climate Leaders of the World Economic Forum.

For this reason, BBVA incorporates sustainability at the heart of its strategy, being, as we have previously mentioned, one of the six established strategic priorities. This strategic priority has been divided into three objectives included in BBVA’s General Sustainability Policy, which are:

In 2018, BBVA presented its 2025 Commitment to channel €100 billion in sustainable finance by 2025 to contribute to the achievement of the SDGs and the challenges arising from the Paris Climate Agreement. Since then, the Group has advanced in the development of this priority, integrating sustainability transversally in internal management and processes and also in the relationship with customers and other stakeholders.

As of December, 2023, the bank had reached €206 billion at a pace that has pushed the bank to raise once again the goal, to €300 billion, three times its initial commitment.

BBVA is also committed to being Net Zero by 2050, not only for its direct emissions, goal already achieved since 2020, but also for indirect emissions, that is, those of the customers it finances. To achieve this goal, BBVA has committed to stop financing coal by 2030, in developed countries, and by 2040 in the rest of the geographies where it operates. In addition, BBVA has set up intermediate objectives to decarbonize its credit portfolio in some of the most carbon-intensive sectors and participates as a founding member of the Net-Zero Banking Alliance (NZBA).

BBVA presents its Community Commitment, by which €550m will be allocated between 2021 and 2025 to social initiatives supporting inclusive growth in the countries where the Group operates. This commitment is a response to the most important social challenges and aims to contribute to a sustainable and inclusive recovery.

BBVA is also committed to transparency and therefore publishes the TCFD Report, following the recommendations of the Task Force on Climate-Related Financial Disclosure sponsored by the Financial Stability Board (hereinafter, FSB). In addition, since 2020 BBVA has published additional sustainability metrics following two of the most advanced standards in the market, such as those issued by the World Economic Forum-International Business Council (hereinafter, WEFIBC) or by the Sustainability Accounting Standards Board (hereinafter SASB).

Alignment of BBVA Group's non-financial information to WEF-IBC and SASB standards

More information