In 2011, income from fees and commissions was very stable, with a year-on-year rise of just 0.5% to €4,560m. The figure is relevant given the environment in which it was achieved: the regulatory limitations in force in some areas, lower activity in Spain and the reduction of some fees to ensure greater customer loyalty. It is worth pointing out that fees related to banking services improved most (up 1.3% year-on-year), while those from the fund management business fell by 1.5% over the same period. This was due to the impact that developments in the markets had on assets under management and the preference shown by customers for other liability products such as time deposits and promissory notes.

After a third quarter in which NTI was negative due to the loss of asset values, reduced activity with customers and the lack of earnings from portfolio sales, NTI moved back into positive territory in the last quarter. This was the result of favorable interest rate hedging operations. For the year as a whole, NTI was €1,479m, with a year-on-year fall of 21.9% due to its positive performance in 2010, above all in the first nine months.

Revenue from dividends, which basically includes BBVA’s stake in Telefónica (which is paid in May and November), was up 6.3% to €562m.

Income by the equity method was €600m (up 79.2% year-on-year), thus maintaining its good performance thanks to the excellent results from CNCB.

The heading other operating income and expenses amounted to €205m in 2011, a fall of 30.6% on the figure for 2010. The positive performance of the insurance business, where revenue was up by 12.7%, does not offset the increased allocations to deposit guarantee funds in the different geographical areas where BBVA operates, or the effect of hyperinflation in Venezuela.

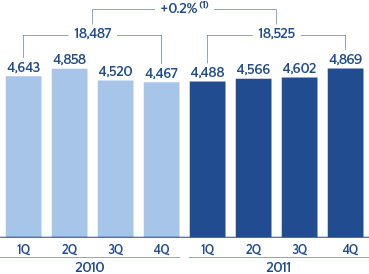

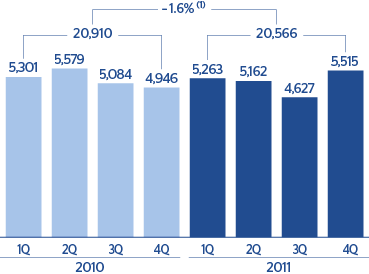

In short, and despite the difficult economic and financial situation in 2011, recurring revenue has continued to rise since the third quarter of 2010. In 2011 as a whole its level was similar to the previous year. Gross income, excluding NTI and dividends, represents 90% of the Bank’s total revenue and totaled €18,525m in 2011 (€18,487m in 2010 and 88% of all revenue last year). Including NTI and dividends, gross income amounted to €20,566m, a year-on-year fall of 1.6%. However, this represents a rise of 0.3% excluding the exchange-rate effect.