WB&AM highlights in the fourth quarter

- Sligh recovery in markets and business activity.

- First collaboration with Garanti in the biggest venture capital deal in Turkish history.

- High asset quality.

The Wholesale Banking & Asset Management (WB&AM) area handles the Group’s wholesale businesses and asset management in all the geographical areas where it operates. It is organized into three main business units: Corporate and Investment Banking, Global Markets and Asset Management.

In a particularly difficult environment in 2011, when most of the European banks announced significant deleveraging plans and there was a notable reduction in activity in wholesale business, BBVA managed to recover competitiveness. This is due to the Group’s superior business model based on customer relations which produces high quality recurrent earnings, as well as reduced leverage. Gross income for the year to December was negatively affected by trading results and went down 3.9% on 2010 to €2,724m. By geographical areas, there was significant growth in Asia, at 6.4% year-on-year, and Europe (excluding Spain), which was up 3.3%.

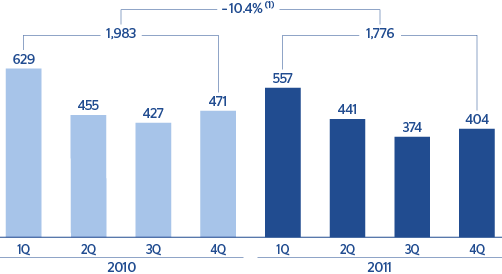

Operating expenses ended the year 15.6% up on the previous year, mainly due to investment plans in IT systems and the various growth plans implemented in the different geographical areas. As a result, the operating income was €1,776m, 11.8% down on the figure for the previous year.

The different business units in this area continue to show high asset quality, and thus, a low NPA ratio, a high coverage ratio and loan-loss provisions that represent 5.1% of operating income. The net attributable profit for the year was €1,122m, down 8.3% on the figure for 2010.

The Corporate and Investment Banking unit of WB&AM, managed gross lending to customers of €48,655m as of 31-Dec-2011, practically the same figure as at the end of the previous quarter. The volume of customer funds is also at the same level as at the close of 30-Sep-2011, at €23,485m. This means that the liquidity gap has been stable over the quarter. Adding these figures to the balances in Global Markets, which were significantly affected by developments in financial markets over 2011, WB&AM ended the year with a loan book of €58,618m and customer funds of €39,644m.

The main transactions in the Group’s wholesale business in the fourth quarter of 2011 are summarized below:

In equity capital markets the Group participated in the issue of convertible bonds by Technip, the capital increase by Grupo de Inversiones Suramericana in Colombia and the capital increase of Galp’s subsidiary in Brazil.

In corporate finance, BBVA once more closed the year as market leader in Spain in M&A, with 16 deals announced in 2011 with a clear cross-border focus (10 deals), and as advisor of choice in the American continent (5 deals). BBVA has been recognized as Best M&A Advisor in Iberia in 2011 by Financial Times - Mergermarket. Among the highlights in the quarter was the sale of Inima to GS Engineering & Construction which was the biggest deal by a Korean company ever in Spain.

In project finance in Spain, BBVA led the financing of a hydrocarbon storage terminal in the Port of Barcelona for Tradebe and a wind farm for Ortiz. In Italy a photovoltaic project was concluded with 9REN, and in the United Kingdom BBVA has structured the finance of the Tram in Nottingham. Highlights in the Americas include the financing of Transportadora de Gas del Perú, S.A. and Transmisora Eléctrica del Sur, S.A., as well as a mandate to provide financial consulting for the Aguas de Lima Sur desalination plant, a mandate to finance the gas pipeline in Chihuahua (Mexico), and the financing of a portfolio of wind farms for Edison Mission (United States). As recognition for the project finance activity of its franchise in the United States, BBVA obtained the “Best Finance House in Renewables 2011” award from Environmental Magazine.

Structured trade finance includes the finance of the extension of the most important refinery in Turkey, with the backing of Cesce. This is the biggest venture capital operation in the history of the country with an investment of USD €3,000m and the collaboration of Garanti. BBVA was awarded with the GTR prize for “Best Trade Finance Bank in Latin America 2011” for the third consecutive year.

Corporate lending activity included financial guarantees backing European Investment Bank finance for its customers. BBVA is still the market leader in Latin American countries in this activity, as it was involved in the most important deals of the year.

In the area of global transactional banking, a performance bond was issued for a railroad macro-project under the Bosphorus Strait. BBVA has been named the “Best Supplier of Cash Management Services” for companies and public institutions in Colombia by Euromoney, and the “Best Internet Bank” in the category of corporate and institutional banking in Puerto Rico by Global Finance. It has also received the “Recommended” category in the Agent Banks survey for Major Markets by Global Custodian and “Top Rated” in the Sub-Custody Survey by Global Investor. Also worth mentioning is its award as Best Trade Finance Bank in Latin America from Global Trade Review, which reflects the opinions of customers in relation to its Transactional Trade Finance services, and first prize in the World’s Best Trade Finance Banks 2012 for BBVA in Spain from the magazine Global Finance.

Despite the uncertainty in 2011, the Group’s customers still support the products and services of Global Markets, which continue to receive acknowledgements from specialized publications. In its 2011 survey, FX Week considers BBVA the fourth most recognized bank among customers, the second most recognized by corporate customers and the fourth among investors in Latin American currencies. BBVA also appears for the first time in FX Week’s ranking of banks at a global level, in 26th place.

In 2011, the results of Global Markets in Spain were affected by limited economic activity and market uncertainty. Despite these, revenue from customers has grown, particularly in strategic businesses such as credit, where income increased by 38% on the previous year. By type of customer (institutional investor, corporates, global public finance, SMEs and retail) there was a notable positive development in global public finance, with revenue up 22% respectively on 2010 figures. Trading activity was affected by high market volatility, the sovereign debt crisis in a number of euro zone countries, and uncertainty associated with regulatory changes. Despite these, BBVA improved its results on 2010 in equity, exchange rate and interest rate products. In Spain, BBVA consolidated its leading position as equity brokerage, with a market share of 16.1% at the end of 2011, 6.9 percentage points above its nearest competitor.

In the rest of Europe and Asia, customer revenue also increased 25% over the last 12 months thanks to the good performance of practically all the products. The biggest revenue still comes from interest rate (up 37%) and equity (up 26%) products.

In Global Markets Mexico, revenue from customers has continued the excellent trend begun some months earlier, with a rise of 24% in year-on-year terms as a result of a positive performance in practically all the products. By type of customer, there was a notable increase in revenue from corporates. In contrast, trading income in 2011 was affected by the turmoil in the markets. Despite this, revenue from exchange rate products was positive (up 23%).

In South America, Global Markets customer revenue grew 7% year-on-year. By product, the biggest increases were in exchange rate (up 33% year-on-year).

In Global Markets United States, the outstanding performers were interest-rate and credit products. By type of customer, there was an increase in corporates, SME’s and retail.

Finally, Asset Management with global assets under management of €72,998m, continues to be a key player in mutual fund and pension fund management in the geographical areas in which it operates. In Spain it has a market share of 15.2% of assets under management in mutual funds and is still the clear leader in pension fund management. In Mexico it maintains its leading position in the management of mutual funds, with a market share of 22.8%, and in the rest of Latin American countries it has continued to grow in line with previous quarters, with a year-on-year increase in assets of 12.5% as of 31-Dec-2011.