In the fourth quarter of 2011, the most notable event with respect to the capital base was the publication by the European Banking Authority (EBA) of the new capital recommendations applicable to certain financial institutions in Europe, aimed at recovering investor confidence in their solvency. These recommendations consist of a minimum core capital ratio of 9% (using the specific criteria defined by the EBA), including an additional exceptional, temporary cushion for exposure to sovereign debt, which will have to be achieved by June 2012.

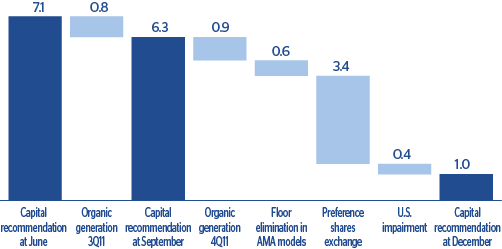

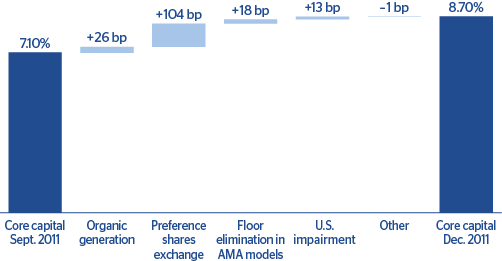

For the BBVA Group, the amount estimated at first in October using information from June 2011, was €7.1 billion. The Group’s strategy to comply with this recommendation is based on the following fundamental pillars: organic generation of capital quarter by quarter; management of capital instruments; and, to a lesser extent, compliance with the forecast timetable for implementing the internal models approved by the Bank of Spain. With data for the close of September, the figure fell to €6.3 billion, of which €2.3 billion correspond to sovereign exposure. The reduction on the original figure was mainly the result of organic capital generation in the third quarter of 2011.

An additional €5.3 billion were generated in the fourth quarter of the year, as follows:

- There was a successful completion of the exchange of preference shares for mandatory convertible bonds, which are 100% eligible as core capital. The exchange was subscribed by nearly all the investors, at 98.7% of the nominal amount, or a total of €3.4 billion.

- A further €0.9 billion of capital was generated organically, explained basically by recurring earnings, the current dividend policy, and the slight increase in lending.

- There was a positive effect from the tax benefit for goodwill impairment in the United States, which amounted to €0.4 billion.

- The floor set by the capital advanced measurement approach for operational risk was eliminated. This floor was established in December 2009 when the internal operational risk models for Spain and Mexico entered into force. The effect has been of an extra €0.6 billion.

Thus, 84% of the capital recommendation has been achieved as of December 31, 2011. In the first half of 2012, the Group’s organic generation of capital will cover the remaining amount. This will allow BBVA to meet with ease the core Tier 1 ratio (according to EBA criteria) of 9% by June 2012.

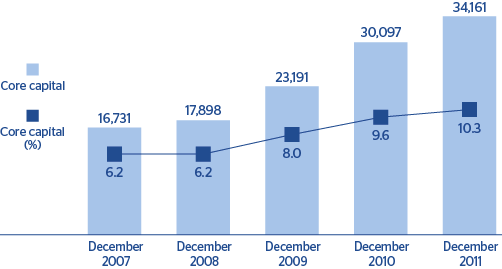

As a result of the above, the capital base according to BIS II standards also substantially improved its quality over the quarter and in the year as a whole. As of December 31, 2011, core capital stood at €34,161m, 15.3% up on the figure for September 2011 and 13.5% more than in December 2010. As a result, the core ratio went up to 10.3%.

Bank capital (Tier I) increased by €2,109m over the quarter, a rise of 6.6%, with the Tier I ratio standing at 10.3% (9.8% as of 30-Sep-2011), an improvement of 48 basis points over the quarter.

Other eligible capital (Tier II) at the same date, which includes subordinate debt, surplus generic provisions, eligible unrealized gains, and the deduction for holdings in financial and insurance entities, was €8,609m, a fall over the quarter of 5.1%, mainly due to the amortization of an subordinated debt issue. As a result, Tier II stood at 2.6% as of 31-Dec-2011 (2.8% as of 30-Sep-2011).

Total capital brings the capital base to €42,770m, 4.0% up on the previous quarter.

Risk-weighted assets (RWA) amounted to €330,771m, an increase of 1.6% on the figure for September, basically due to exchange-rate variations and the slight growth in lending over the quarter, above all in Mexico and South America. The entry into force of the tighter Basel 2.5 requirements (increased RWA for market risk when including stressed VaR) was offset by a lower operational risk requirement due to the elimination of the capital floor in the advanced models.

Finally, the BIS ratio as of 31-Dec-2011 stood at 12.9% (12.6% as of 30-Sep-2011).