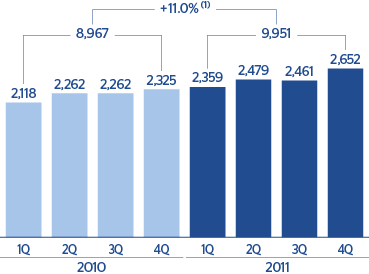

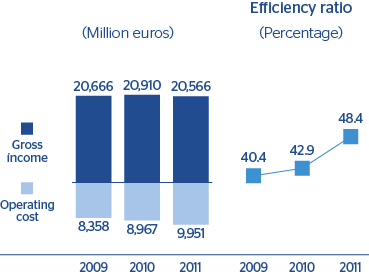

Operating expenses in 2011 amounted to €9,951m, a year-on-year increase of 11.0%. The rise is due to the change in perimeter (incorporation of Garanti), the investment process underway in BBVA, and the effort made in staff training to promote talent. BBVA has been recognized as the best European company in developing the leadership skills of its teams by Fortune magazine. Despite the increase in costs, the efficiency ratio closed December at an outstanding level of 48.4%, one of the lowest in the banking sector worldwide.

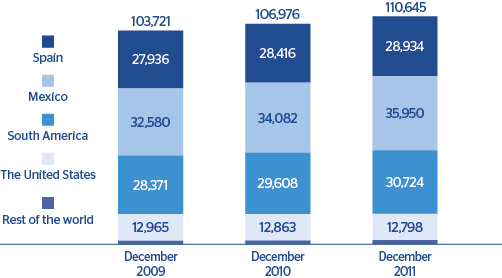

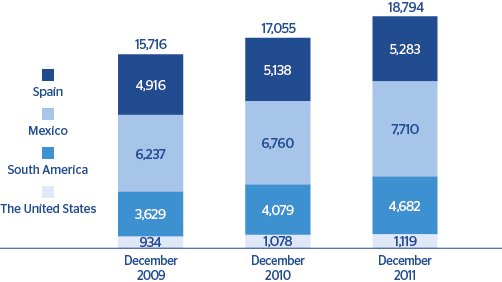

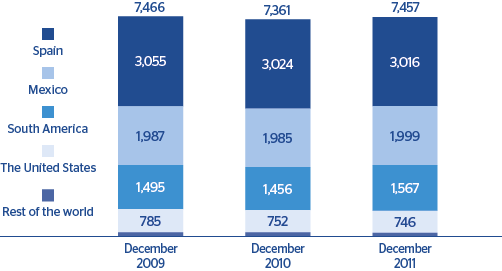

As of 31-Dec-2011, the Bank employed 110,645 people, practically the same number as at the close of September, with year-on-year growth of 3.4%. Its branch network numbered 7,457 units, with 21 additional branches than at the close of September, and 96 more than at the close of 2010. As has been the case recently, branches continue stable in Spain at a time when the sector has just begun a process of reducing branch numbers. BBVA began the same process in 2006 and completed it over 2009. In contrast, the branch network in emerging countries is increasing (basically in Mexico and South America) as a result of the expansion processes underway in these countries, aimed at taking advantage of the growth opportunities offered by their markets. Finally, the number of ATMs continues to grow. It closed December 2011 at 18,794, 602 more than in the third quarter and 1,739 above the figure at the close of 2010. As is the case with branches, the increase is focused mainly in emerging countries, while developed countries show no significant changes, although in this case investment is focused on their renewal and modernization.

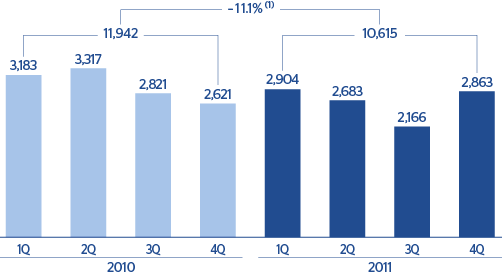

To sum up, the changes mentioned above in revenue and expenses have resulted in an operating income of €10,615m in 2011 (€11,942m in 2010).