Eurasia highlights in the fourth quarter

- Start of collaboration and generation of synergies with Garanti.

- Year-on-year growth of the profit reported by CNCB for 3Q: +41%.

- Positive performance of business in Europe.

- Eurasia confirms its contribution in terms of earnings and diversification.

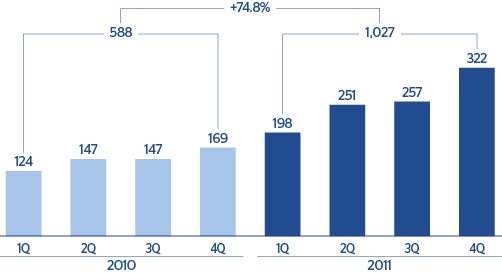

This area covers BBVA’s activity in Europe (excluding Spain) and Asia. In other words, it includes BBVA Portugal, Consumer Finance Italy and Portugal, the retail business of branches in Paris, London and Brussels (in 2010 these were reported in Spain and Portugal), and WB&AM activity (Corporate and Investment Banking, Global Markets and CNCB) within this geographical area. It also covers the Group’s stake in Garanti.

From a macroeconomic point of view, the performance of this business area is twofold due to different evolution of the advanced economies in Europe, on the one hand, and emerging economies such as China and Turkey on the other. In the fourth quarter of 2011 the European economy as a whole showed weak growth. However, this growth continues to be uneven. The peripheral countries showed the greatest slowdown, or even entered into a renewed recession, while those in central Europe posted higher rates of growth. The resurgence of the financial turmoil starting mid-way through the year, and the publication of data showing greater weakness in the core regions, spurred a change in expectations regarding a toughening of monetary policy. As a result, the ECB has reversed the early rise in rates and has continued its policy of supporting liquidity in a context where inflation is slightly above target. In contrast, Asia and Turkey have maintained their growth rates, although at lower levels than in previous periods. This is due to the slowdown in global growth, and the adoption by local authorities of economic policies designed to prevent overheating.

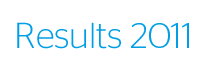

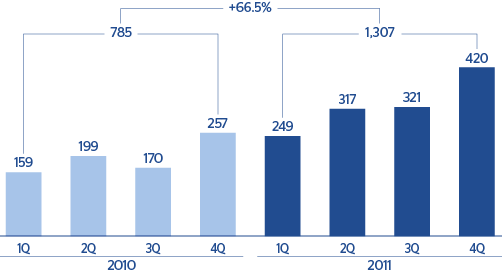

As a result, Eurasia continues to perform well overall, generating an accumulated net attributable profit for the year of €1,027m, or 25.6% of the Group’s total earnings excluding one-offs. This net attributable profit added geographical diversification to the Group and reflects its commitment to emerging countries with economic growth potential.

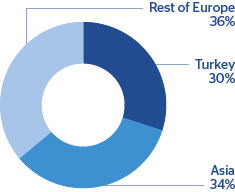

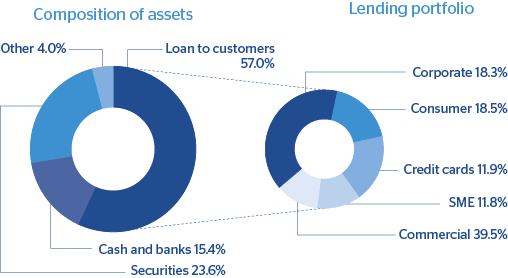

In terms of business activity in the area, gross lending to customers as of 31-Dec-2011 was at similar levels to the previous quarter, at €34,740m. This represents a year-on-year increase of 43.1%, due to the incorporation of Garanti. Excluding the contribution from the Turkish bank, the loan book remained very stable, with an increase of 3.2%.

Customer funds totaled €21,470m, a fall of 5.8% over the quarter due to global businesses in Europe, as deposits in Turkey continue to show a good performance.

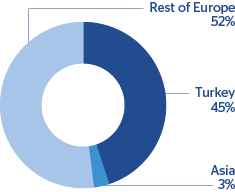

By business unit, Europe accounts for 45% of earnings for the year. Its positive growth can mainly be explained by the consolidation of Garanti, and to a lesser extent by the good performance of the rest of the local businesses. It is worth noting the positive performance of gross income, which amounted to €1,283m, 95.1% up on the previous 12 months. Excluding Garanti, gross income growth was 6.9%, despite the unfavorable situation of the financial markets. As a result, the net attributable profit rose 86.1% to €464m, or 8.7% excluding Garanti.

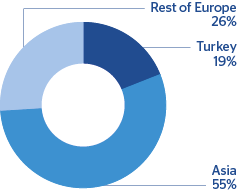

Asia accounts for 55% of results in the area. The net attributable profit was up by 66.4%, mainly due to the growing contribution from CNCB, whose activity and earnings are increasing quarter by quarter. According to the latest available figures to September 2011, the loan book increased by 9.4% on the figure for the close of 2010, customer deposits grew by 8.0% and the accumulated net attributable profit for the year was up 40.9% year-on-year. Overall, Asia generated gross income of €669m (up 58.3% year-on-year) and a net attributable profit of €563m.

In the fourth quarter of 2011, BBVA continued to make progress in its strategic alliance with CNCB aimed at exploring new business opportunities. In addition, the Bank has been recognized as the Best Trainer of Chinese Professionals by the prestigious association China Club. The award recognizes the Group’s work to attract talent in the Asian country.

The most notable aspects of Garanti in the fourth quarter of 2011 are as follows (data for Garanti Bank):

- Continued sound progress in the loan book (up 29.6% year-on-year), although at a slower pace than in previous quarters. This is due to the Central Bank’s policies designed to prevent the Turkish economy from overheating. However, it is worth noting that lending growth in Garanti over the quarter was above the sector as a whole (up 3.3% in Garanti and up 2.7% in the sector). More specifically, the retail portfolio showed outstanding growth across the board (consumer finance, mortgages and credit cards).

- Customer deposits have maintained their upward trend (up 5.5% over the quarter and 17.5% over the year) also above those for the rest of the sector (up 1.9% over the quarter and 12.5% for the year).

- The bank’s gross income rose to €1,807m, a rise of 6.6% over the last 12 months. This performance is explained by the appropriate mix in the loan book and customer funds, the positive price management with repricing of the loan portfolio, and the favorable trend in business activity.

- Garanti continues to be an example in the Turkish banking sector in terms of efficiency, with operating expenses rising below inflation.

- It also has an excellent asset quality, with NPL and coverage ratios of 1.8% and 82% respectively, significantly better than those of the rest of the sector.

- As a result, Garanti generated a net attributable profit of €1,313m.

Finally, it is worth highlighting that the Turkish bank and BBVA have started to collaborate. Specific working teams have been set up with members from both banks to identify and implement projects that can help increase the value of the Group’s franchises. One of the projects in place is the identification of corporate customers with a presence or interest in Turkey. Work is already underway with these customers on specific new financial transactions. With regard to technology, given Garanti’s sound technological and operational platform, plans have been implemented to exchange know-how between Garanti, BBVA Bancomer and BBVA Spain.