In the difficult economic scenario described above, BBVA generated a net attributable profit of €3,004m. Excluding the one-off charge due to goodwill impairment in the United States, the figure is €4,015m.

By business areas, Spain generated €1,363m, Eurasia €1,027m, Mexico €1,741m, South America €1,007m and the United States a loss of €722m (a gain of €289m excluding the goodwill impairment).

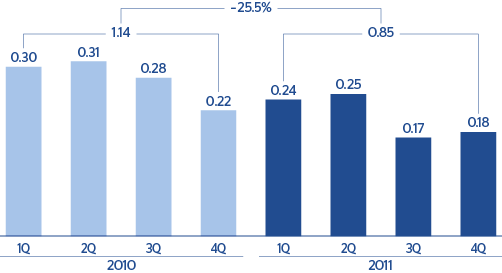

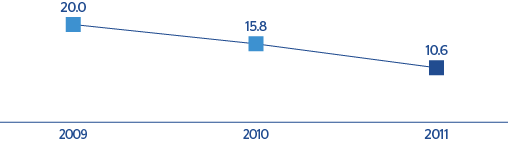

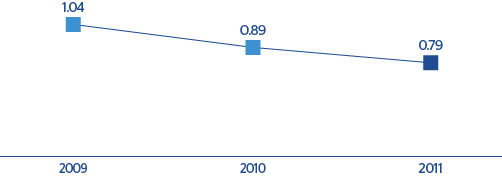

The cumulative earnings per share (EPS) for the year were €0.64 (€0.85 excluding one-offs), compared with €1.14 in 2010, after adjusting for the effects of the capital increase in November 2010, April 2011 and October 2011. The increase in the Group’s capital has moved the book value per share up by 2.2% year-on-year to €8.35. ROE excluding one-offs stood at 10.6% (8.0% with one-offs) and return on total average assets (ROA) at 0.79% (0.61% with one-offs). These ratios keep BBVA as one of the most profitable banks in its peer group.