The BBVA Group’s income statement for the fourth quarter of 2011 has a significantly high level of revenue, which has allowed for a higher effort in loan-loss provisions. The most significant aspects of the statement are detailed below:

- The continuing upward trend in the most recurring revenue, i.e. gross income excluding NTI and dividends:

- Net interest income has risen for the fourth quarter in a row thanks to the increased business activity in emerging countries and appropriate price management carried out in all geographical areas.

- Income from fees and commissions were stable, despite the regulatory limitations in force in some areas, lower activity in Spain and greater efforts to maintain customer loyalty.

- Equity-accounted income was up considerably boosted by the contribution from CNBC.

- There was also a significant contribution from NTI after a particularly low third quarter, and from dividends, which include the payment from the stake in Telefónica.

-

Impairment losses on financial assets were up over the quarter, basically due to the increase of the Group’s loan-loss provisions, which took advantage of the higher revenue. Nonetheless, the figure for the year as a whole is 10.4% down on 2010.

- There was an adjustment to the value of goodwill in the United States of €1,011m after tax. Despite the positive performance of the franchise in 2011, the slower-than-expected economic recovery and low interest rates outlook, combined with growing regulatory pressure, all imply a slowdown in forecast earnings growth in this area. This adjustment is of an accounting nature only and does not have any negative consequence on the Group’s liquidity or capital adequacy.

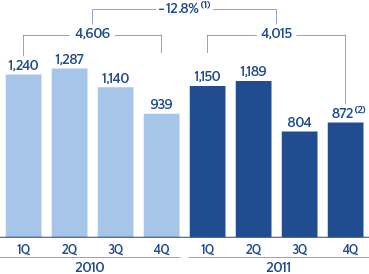

- The net attributable profit before applying the goodwill impairment was €872m in the fourth quarter and €4,015m for the year as a whole. Including the adjustment, the Group’s net attributable profit for 2011 came to €3,004m.

Consolidated income statement: quarterly evolution

(Million euros)

|

2011 |

2010 |

|

4Q |

3Q |

2Q |

1Q |

4Q |

3Q |

2Q |

1Q |

| Net interest income |

3,485 |

3,286 |

3,215 |

3,175 |

3,138 |

3,245 |

3,551 |

3,386 |

| Net fees and commissions |

1,136 |

1,143 |

1,167 |

1,114 |

1,135 |

1,130 |

1,166 |

1,106 |

| Net trading income |

416 |

(25) |

336 |

752 |

252 |

519 |

490 |

633 |

| Dividend income |

230 |

50 |

259 |

23 |

227 |

45 |

231 |

25 |

| Income by the equity method |

207 |

150 |

123 |

121 |

124 |

60 |

94 |

57 |

| Other operating income and expenses |

42 |

22 |

62 |

79 |

70 |

85 |

47 |

93 |

| Gross income |

5,515 |

4,627 |

5,162 |

5,263 |

4,946 |

5,084 |

5,579 |

5,301 |

| Operating costs |

(2,652) |

(2,461) |

(2,479) |

(2,359) |

(2,325) |

(2,262) |

(2,262) |

(2,118) |

| Personnel expenses |

(1,404) |

(1,325) |

(1,306) |

(1,276) |

(1,240) |

(1,211) |

(1,215) |

(1,149) |

| General and administrative expenses |

(1,021) |

(920) |

(964) |

(887) |

(887) |

(855) |

(855) |

(796) |

| Depreciation and amortization |

(227) |

(216) |

(208) |

(196) |

(199) |

(197) |

(192) |

(174) |

| Operating income |

2,863 |

2,166 |

2,683 |

2,904 |

2,621 |

2,821 |

3,317 |

3,183 |

| Impairment on financial assets (net) |

(1,337) |

(904) |

(962) |

(1,023) |

(1,112) |

(1,187) |

(1,341) |

(1,078) |

| Provisions (net) |

(182) |

(94) |

(83) |

(150) |

(75) |

(138) |

(99) |

(170) |

| Other gains (losses) |

(1,718) |

(166) |

(154) |

(71) |

(273) |

113 |

(88) |

(72) |

| Income before tax |

(375) |

1,002 |

1,484 |

1,659 |

1,162 |

1,609 |

1,789 |

1,862 |

| Income tax |

368 |

(95) |

(189) |

(369) |

(127) |

(359) |

(431) |

(510) |

| Net income |

(7) |

907 |

1,295 |

1,290 |

1,034 |

1,250 |

1,358 |

1,352 |

| Non-controlling interests |

(132) |

(103) |

(106) |

(141) |

(96) |

(110) |

(70) |

(113) |

| Net attributable profit |

(139) |

804 |

1,189 |

1,150 |

939 |

1,140 |

1,287 |

1,240 |

| Net one-offs (1) |

(1,011) |

- |

- |

- |

- |

- |

- |

- |

| Net attributable profit (excluding one-offs) |

872 |

804 |

1,189 |

1,150 |

939 |

1,140 |

1,287 |

1,240 |

| Basic earnings per share (euros) |

(0.03) |

0.17 |

0.25 |

0.24 |

0.22 |

0.28 |

0.31 |

0.30 |

| Basic earnings per share excluding one-offs (euros) (1) |

0.18 |

0.17 |

0.25 |

0.24 |

0.22 |

0.28 |

0.31 |

0.30 |

(1) In the fourth quarter of 2011 a charge was booked for goodwill impairment in the United States. The third quarter of 2010 includes capital gains from the sale-and-leaseback of retail branches which have been allocated to generic provisions for NPA, with no effect on net attributable profit.

Consolidated income statement

(Million euros)

|

2011 |

Δ% |

Δ% at constant exchange rates |

2010 |

| Net interest income |

13,160 |

(1.2) |

1.0 |

13,320 |

| Net fees and commissions |

4,560 |

0.5 |

2.6 |

4,537 |

| Net trading income |

1,479 |

(21.9) |

(20.4) |

1,894 |

| Dividend income |

562 |

6.3 |

6.7 |

529 |

| Income by the equity method |

600 |

79.2 |

79.3 |

335 |

| Other operating income and expenses |

205 |

(30.6) |

(32.7) |

295 |

| Gross income |

20,566 |

(1.6) |

0.3 |

20,910 |

| Operating costs |

(9,951) |

11.0 |

13.3 |

(8,967) |

| Personnel expenses |

(5,311) |

10.3 |

12.4 |

(4,814) |

| General and administrative expenses |

(3,793) |

11.8 |

14.5 |

(3,392) |

| Depreciation and amortization |

(847) |

11.3 |

13.9 |

(761) |

| Operating income |

10,615 |

(11.1) |

(9.5) |

11,942 |

| Impairment on financial assets (net) |

(4,226) |

(10.4) |

(8.7) |

(4,718) |

| Provisions (net) |

(510) |

5.7 |

6.6 |

(482) |

| Other gains (losses) |

(2,109) |

n.m. |

n.m. |

(320) |

| Income before tax |

3,770 |

(41.3) |

(40.1) |

6,422 |

| Income tax |

(285) |

(80.1) |

(79.6) |

(1,427) |

| Net income |

3,485 |

(30.2) |

(28.9) |

4,995 |

| Non-controlling interests |

(481) |

23.8 |

27.8 |

(389) |

| Net attributable profit |

3,004 |

(34.8) |

(33.7) |

4,606 |

| Net one-offs (1) |

(1,011) |

n.m. |

n.m. |

- |

| Net attributable profit (excluding one-offs) |

4,015 |

(12.8) |

(11.3) |

4,606 |

| Basic earnings per share (euros) |

0.64 |

(44.1) |

|

1.14 |

| Basic earnings per share excluding one-offs (euros) (1) |

0.85 |

(25.5) |

|

1.14 |

(1) In the fourth quarter of 2011 a charge was booked for goodwill impairment in the United States. The third quarter of 2010 includes capital gains from the sale-and-leaseback of retail branches which have been allocated to generic provisions for NPA, with no effect on net attributable profit.

Net attributable profit

(Million euros)

(1) At constant exchange rate: -11.3%.

(2) Excluding one-offs.