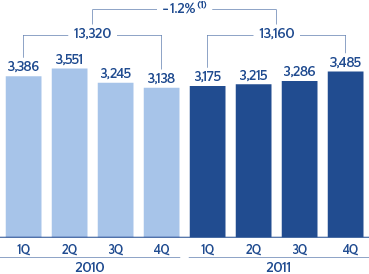

The Group’s net interest income in the fourth quarter of 2011 rose again for the fourth quarter in a row to €3,485m, 6.0% up on the previous quarter and 11.0% up on the figure for the same period the previous year. Net interest income has reached its highest level since June 2010, before the cost of funds rose in Spain. The result has been boosted by a number of factors: the increased volume of business in emerging countries, the contribution from Garanti (bigger in this quarter and non-existent 12 months previously) and appropriate spread management. Over the year as a whole, the net interest income amounted to €13,160m, barely 1.2% below the figure for 2010, but 1.0% above it excluding the impact of the exchange rate.

The defense of spreads within the Group can be seen in all the geographical areas. In the euro zone resident sector, yield on loans once more rose by 1 basis point in the fourth quarter and closed the year at 3.86%. This is due to the gradual repricing of the loan portfolio and the positive spreads in new loans. Cost of deposits remains at 1.75%. As a result, customer spreads continued to increase from 2.10% in the third quarter to 2.11% at the close of 2011.

In Mexico, interbank rates remained practically at the same levels throughout 2011. However, the yield on loans once more increased by 18 basis points over the quarter to 13.28%, thanks to the good new production figures, mainly in consumer finance and credit cards. Cost of deposits fell by 13 basis points over the same period to 1.84%. To sum up, the customer spread rose to 11.45% (11.14% in the previous quarter) and the cumulative net interest income in the area was up 7.2% year-on-year at constant exchange rates, with sustained growth each quarter.

The net interest income in South America continues to post high year-on-year growth rates (up 31.6%, excluding the exchange-rate effect). This positive performance can be explained by the strength of business activity, together with excellent defense of spreads in the area.

Finally, the United States franchise continues to show a high resilience in net interest income in the quarter at constant exchange rates. This is very significant, taking into account the gradual shift in composition of the loan portfolio toward lower-risk products with narrower spreads. This resilience is the result of an appropriate management of customer spreads.