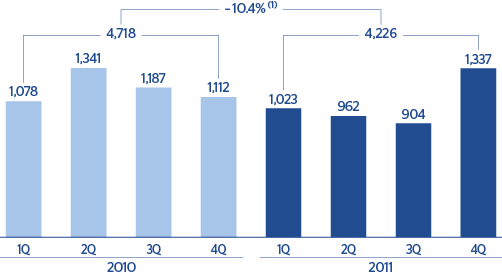

Impairment losses on financial assets amounted to €4,226m in 2011, a fall of 10.4% on the figure for the previous year. In the fourth quarter there was an increase in the level of the Group’s loan-loss provisions, aimed at taking advantage of the higher revenue over the last three months of the year. This has had a positive impact on BBVA’s coverage ratio, which closed 31-Dec-2011 at 61%. Another important point is that the Bank’s cumulative risk premium has improved 14 basis points along the year, closing 2011 at 1.20%.

Provisions amounted to €510m in 2011, 5.7% up on the figure for the previous year. They basically cover early retirement, other allocations to pension funds and transfers to provisions for contingent liabilities.

The heading other gains (losses) reported a negative €2,109m in 2011. This can be explained almost entirely by two concepts: a negative €665m corresponding to provisions made for real estate and foreclosed assets with the aim of maintaining coverage above 30%; and a negative €1,444m for goodwill impairment in the United States. In 2010 the figure was a negative €320m, mainly from the adjustment of the value of foreclosed or acquired assets in Spain.

In general, the 2011 corporate tax rate was low due to revenue with a low or no tax rate (mainly dividends and income by the equity method) and the growing weight of earnings from the Mexico, South America and Turkey, where effective tax rates are low.