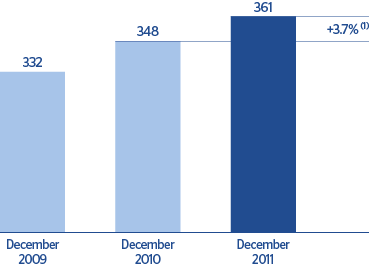

Gross customer lending closed December 2011 at €361 billion. This represents a rise over the year of 3.7% (up 4.3% at constant exchange rates) and of 2.5% in the quarter.

By business areas, Mexico has performed well, with a year-on-year growth of 8.1% at constant exchange rates (up 9.3% excluding the old mortgage portfolio). This positive performance was basically due to the increase in the retail portfolio, mainly consumer finance and credit cards, which together grew by 23.6%. South America also continues to show a significant increase in lending, with a rise over the last twelve months of 27.0% (also at constant exchange rates). In the United States, there was a notable increase in new production in the target portfolios (commercial and residential real estate), which led to a year-on-year increase of 21.5% in residential real estate and 23.0% in corporate unsecured loans (these rates do not take into account the exchange-rate effect). Lending in Eurasia was up 43.1% thanks to the positive contribution from Garanti. In Spain lending fell back by 1.8%.

Within the domestic sector, the general tone is still weakness in new production. On the contrary, the non-domestic sector continues to grow in practically all the categories, with a rate of change that is positive both over the quarter (up 5.2%) and for the last 12 months (up 14.1%).

Finally, NPL have remained stable since 2009.