Fiscal Policy

BBVA has the commitment to provide its clients with the best solutions, to offer a profitable and sustainable growth to its shareholders and to cooperate to the advancement of the societies where it is present. These values are reflected in BBVA's tax policies and in line with its corporate values: tax integrity, prudence in the fiscal context and transparency in the information it provides about its activities.

Fiscal Policy Report

Corporate principles in BBVA’s tax (in Spanish)

Corporate principles in BBVA’s tax and fiscal strategy

Furthermore, BBVA continues advancing in its fiscal regulation model through the annual publication of its fiscal contribution since 2011, to provide everyone with an interest with information about its fiscal situation, adopting a role of leadership when it comes to transparency.

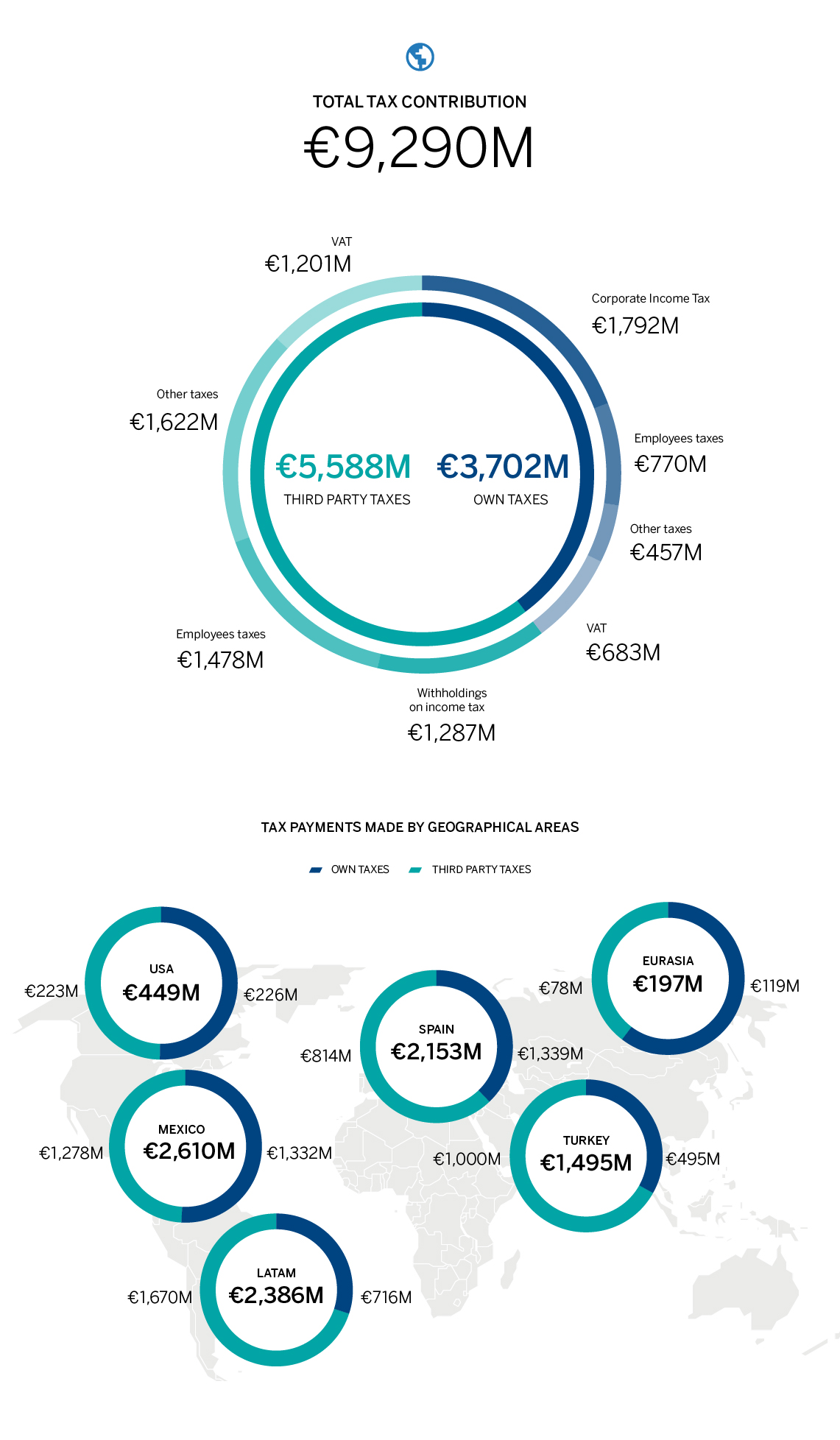

Total tax contribution

Updated page 30 March 2021