In conclusion, the positive performance of recurring revenues and loan-loss provisions has allowed the BBVA Group to continue with its expansion plans designed to lay the foundations for future growth while generating a net attributable profit of €804m in the second quarter and €3,143m year to date. This performance is in an adverse market environment, despite which all the business areas are generating positive results. In this regard, Spain generated €1,162m year to date, Eurasia €705m, Mexico €1,275m, South America €754m, and the United States €218m.

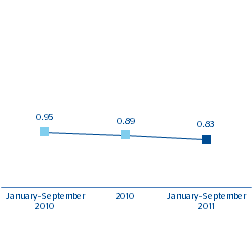

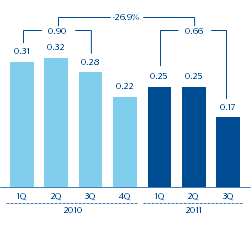

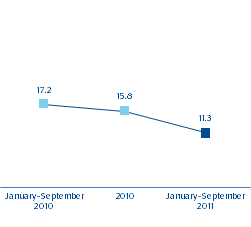

Earnings per share (EPS) year to date (30-Sep-2011) stood at €0.66 compared with €0.90 in the same period in 2010, after correcting for the effects of the capital increases in November 2010 and April 2011. The increase in the Group’s shareholders’ funds has led to a 2.1% year-on-year increase in the book value per share to €8.61. Finally, ROE was 11.3% and return on average assets (ROA) 0.83%, making BBVA one of the most profitable banks in its peer group.

Earnings per share

(Euros)

ROE

(Percentage)

ROA

(Percentage)