| Income statement (Million euros) |

|

|

|

|---|---|---|---|

|

|

Eurasia | ||

|

|

January-Sep. 11 | ∆% | January-Sep. 10 |

| Net interest income | 516 | 108.7 | 247 |

| Net fees and commissions | 287 | 71.9 | 167 |

| Net trading income | 83 | (8.1) | 90 |

| Other income/expenses | 433 | 81.8 | 238 |

| Gross income | 1,319 | 77.6 | 743 |

| Operating costs | (432) | 101.5 | (215) |

| Personnel expenses | (237) | 81.4 | (130) |

| General and administrative expenses | (164) | 129.4 | (71) |

| Depreciation and amortization | (32) | 151.0 | (13) |

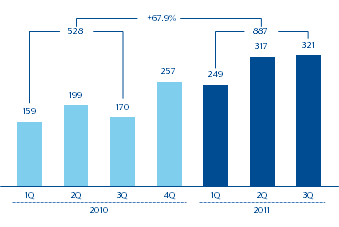

| Operating income | 887 | 67.9 | 528 |

| Impairment on financial assets (net) | (67) | 214.9 | (21) |

| Provisions (net) and other gains (losses) | 17 | n.s. | (12) |

| Income before tax | 837 | 69.1 | 495 |

| Income tax | (132) | 70.0 | (77) |

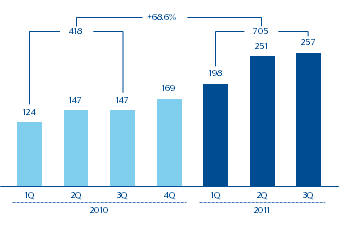

| Net income | 705 | 68.9 | 418 |

| Non-controlling interests | - | n.s. | 1 |

| Net attributable profit | 705 | 68.6 | 418 |

| Balance sheet (Million euros) |

|

|

|

|---|---|---|---|

|

|

Eurasia | ||

|

|

30-09-11 | ∆% | 30-09-10 |

| Cash and balances with central banks | 1,908 | n.s. | 290 |

| Financial assets | 11,110 | 74.5 | 6,367 |

| Loans and receivables | 38,492 | 46.9 | 26,211 |

| Loans and advances to customers | 34,188 | 44.7 | 23,622 |

| Loans and advances to credit institutions and other | 4,304 | 66.3 | 2,589 |

| Inter-area positions | - | n.s. | 15,879 |

| Tangible assets | 576 | 61.0 | 358 |

| Other assets | 1,169 | 190.6 | 402 |

| Total assets/Liabilities and equity | 53,254 | 7.6 | 49,507 |

| Deposits from central banks and credit institutions | 16,908 | (13.7) | 19,591 |

| Deposits from customers | 22,504 | (8.7) | 24,657 |

| Debt certificates | 864 | n.s. | - |

| Subordinated liabilities | 2,010 | 49.4 | 1,345 |

| Inter-area positions | 3,146 | n.s. | - |

| Financial liabilities held for trading | 319 | (25.3) | 427 |

| Other liabilities | 2,650 | 151.1 | 1,055 |

| Economic capital allocated | 4,854 | 99.6 | 2,432 |

| Significant ratios (Percentage) |

|

|

|

|---|---|---|---|

|

|

Eurasia | ||

|

|

30-09-11 | 30-06-11 | 30-09-10 |

| Efficiency ratio | 32.8 | 31.2 | 28.9 |

| NPA ratio | 1.5 | 1.3 | 0.9 |

| NPA coverage ratio | 117 | 143 | 139 |

| Risk premium | 0.28 | 0.33 | 0.12 |

Eurasia highlights in the third quart

- Strong business activity in Turkey.

- High growth of the contribution from Asia.

- Resilience of global businesses in Europe.

- Payment of the CNCB share capital increase.

This area covers BBVA’s activity in Europe (excluding Spain) and Asia. In other words, it includes BBVA Portugal, Consumer Finance Italy and Portugal, the retail business of branches in Paris, London and Brussels (in 2010 these were reported in Spain and Portugal), and WB&AM activity (Corporate and Investment Banking, Global Markets and CNCB) within this geographical area. It also covers the Group’s stake in Garanti.

The economic situation in Eurasia is one of great disparity. In Europe, the situation in the third quarter was characterized by uncertainty and a focus on resolving the debt crisis. These doubts have been affecting the financial system of the euro zone and are leading to funding difficulties in the wholesale markets. In Turkey, however, a good rate of business activity has been sustained, though inflation remains relatively high. Finally, the Chinese economy still appears sound, despite the effects of the slowdown caused by the heightened weakness of foreign demand.

The area is of increasing importance both in terms of earnings and the balance sheet, and has increased the Group’s diversification and growth capacity. From January to September 2011, Eurasia generated a net attributable profit of €705m. This figure represents 17.2% of the earnings generated by the Group’s business areas or 22.4%, if the aggregate of Corporate Activities is included.

In the third quarter of 2011 the increased contribution of CNCB was remarkable as it maintained significant growth in its banking business. Its loan-book was up 7.2% in the first half of 2011 compared to the close of 2010; customer deposits grew 8.2% for the same period; and the net attributable profit for the semester was up 40.6% year-on-year. The success of CNCB’s share capital increase done through July and August of 2011, in which BBVA took part in order to maintain its 15% holding, also merits mention. Two factors have influenced the decision to undertake this operation: on the one hand, the need for it, due to the great strength of banking activity; and on the other hand, the wishes of the Chinese supervisor to maintain a highly solvent partner such as BBVA with the same stake as before the operation. The rest of the units, in general, presented stability with respect to previous quarters.

| Eurasia. Operating income (Million euros)  |

Eurasia. Net attributable profit (Million euros)  |

|---|

Gross lending to customers amounted to €34,960m as of 30-Sep-2011, a 5.0% increase in the quarter. This was explained by the positive contribution of practically all of the business units. Broken down by segment, loans to global businesses rose, while the balance for local business remained stable.

Customer funds decreased 17.2% in the quarter to €22,069m. This is due primarily to the decrease of balances in Europe.

The most notable aspects of Garanti in the third quarter of 2011 are as follows:

- Even though the Turkish Central Bank is taking actions to prevent the overheating of the economy, the lending activity maintains solid growth, which is particularly noticeable in personal loans.

- Favorable performance of the customer spread thanks to the repricing efforts.

- Positive performance of customer deposits, which progressed better than the sector average. This was due to the successful customer attraction campaigns carried out by the SME and individual customer segments.

- Asset quality remains excellent, with an NPA ratio much lower than that of the sector.

| Garanti. Significant data (30-06-2011) (1) |

|

|---|---|

|

|

30-06-11 |

| Financial statements (million euros) |

|

| Attributable profit | 874 |

| Total assets | 65,620 |

| Loans to customer | 34,576 |

| Deposits from customers | 35,970 |

| Relevant ratios (%) |

|

| Efficiency ratio | 42.3 |

| NPA ratio | 2.2 |

| Other information |

|

| Number of employees | 19,784 |

| Number of branches | 894 |

| Number of ATMs | 3,144 |

(1) BRSA data for the group.

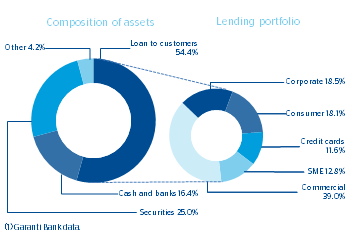

Garanti. Composition of assets and lending portfolio (1) (September 2011) |

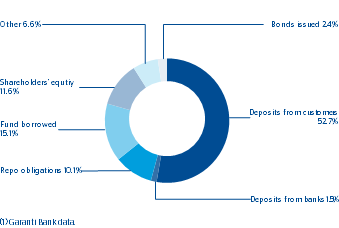

Garanti. Composition of liabilities (1) (September 2011)  |

|---|