Capital base

As of 30-Sep-2011, the BBVA Group’s capital base, calculated according to the BIS II regulation, totaled €41,120m, a very similar figure to 30-June-2011 (down 0.3%). The most significant differences in the quarter include: an increase in core capital of €855m, explained by the generation of earnings in the period, and the higher deduction from the investment made in CNCB. In addition, there was significant movement in currencies in the quarter, specifically the depreciation of the Mexican peso, which has had a negative impact on the capital base.

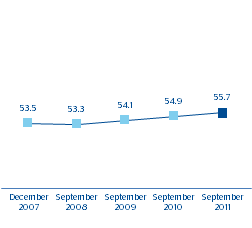

Risk-weighted assets (RWAs) were up 1.3% in the quarter to €325,458m. This growth is fundamentally explained by the strong performance of activity in Latin America and by the appreciation of the dollar and other currencies in South America. Another differentiating key quality aspect of BBVA versus its European peers is the high RWA density and its stability through time.

RWA’s / Total assets (1)

(Percentage)

The minimum capital requirements (8% of RWA) totaled €26,037m, making the capital base surplus at the close of September reach €15,083m, that is, 57.9% above the minimum required levels.

As of 30-Sep-2011, core capital was up 3.0% with respect to the June 2011 figure and amounted to €29,628m, and a core ratio of 9.1%. The organic generation of capital in the quarter was 15 basis points, net of the impact of the currency evolution and other factors.

| Capital base (BIS II Regulation) (Million euros) |

|

|

|

|

|

|---|---|---|---|---|---|

|

|

30-09-11 | 30-06-11 | 31-03-11 | 31-12-10 | 30-09-10 |

| Shareholders' funds | 41,552 | 38,677 | 38,107 | 36,689 | 31,610 |

| Adjustments and deductions | (11,923) | (11,904) | (11,654) | (8,592) | (8,642) |

| Mandatory convertible bonds | - | 2,000 | 2,000 | 2,000 | 2,000 |

| Core capital | 29,628 | 28,773 | 28,452 | 30,097 | 24,969 |

| Preference shares | 5,157 | 5,114 | 5,128 | 5,164 | 5,165 |

| Deductions | (2,733) | (2,452) | (2,367) | (2,239) | (1,900) |

| Capital (Tier I) | 32,053 | 31,435 | 31,214 | 33,023 | 28,234 |

| Subordinated debt and other | 11,800 | 12,266 | 12,613 | 12,140 | 12,955 |

| Deductions | (2,733) | (2,452) | (2,367) | (2,239) | (1,900) |

| Other eligible capital (Tier II) | 9,067 | 9,814 | 10,246 | 9,901 | 11,055 |

| Capital base | 41,120 | 41,249 | 41,460 | 42,924 | 39,289 |

| Minimum capital requirement (BIS II Regulation) | 26,037 | 25,703 | 25,523 | 25,066 | 24,506 |

| Capital surplus | 15,083 | 15,547 | 15,937 | 17,858 | 14,783 |

| Risk-weighted assets | 325,458 | 321,282 | 319,044 | 313,327 | 306,319 |

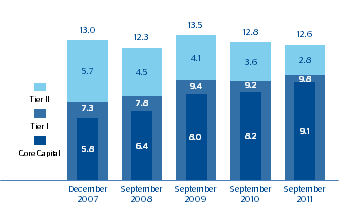

| BIS ratio (%) | 12.6 | 12.8 | 13.0 | 13.7 | 12.8 |

| Core capital (%) | 9.1 | 9.0 | 8.9 | 9.6 | 8.2 |

| Tier I (%) | 9.8 | 9.8 | 9.8 | 10.5 | 9.2 |

| Tier II (%) | 2.8 | 3.1 | 3.2 | 3.2 | 3.6 |

The Tier I ratio, 9.8%, fell with respect to 30-Jun-2011 by 6 basis points. The level of preference shares is similar to that in the previous quarter, at €5,157m, or 16.0% of total bank capital.

The rest of the eligible capital, Tier II, which mainly consists of subordinated debt, surplus generic provisions, eligible unrealized capital gains and the deduction for holdings in financial and insurance entities, stands at €9,067m. This represents a 7.6% decrease in the quarter due to the investment in CNCB and to the fall in unrealized capital gains.

Capital base: BIS II ratio

(Percentage)

To sum up, the BIS ratio as of 30-September-2011 was 12.6% with a clear positive evolution in the quality of its components since the start of the crisis.