The BBVA Compass banking group (hereinafter, BBVA Compass) basically includes the retail and corporate banking business in the United States, excluding Puerto Rico. This unit has taken several key steps in 2011 to improve its position with respect to operations in the current economic environment and thus maintain profitability.

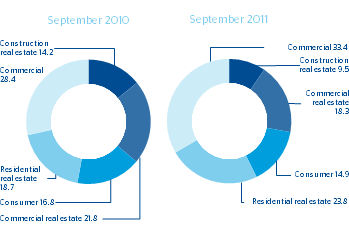

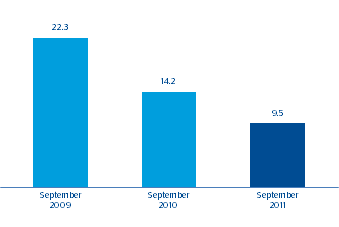

Gross customer lending closed 30-Sep-2011 at €31,503m, practically the same amount as in September 2010 and 2.7% above that for 30-Jun-2011. The C&I portfolio (not including developer loans nor secured loans) showed the biggest rise in the quarter, at 12.7%. Recent industry data report for the sector released by the Federal Reserve showed that corporate lending increased 3% on the previous quarter. Residential real estate is also up, in line with the bank’s new management priorities, with a quarter-on-quarter rise of 4.4% and a year-on-year rise of 29.9%. In contrast, loans to the developer sector continue to fall, both over the quarter (down 5.6%) and over the year (down 31.4%), in line with the strategy of reducing risk in these type of portfolios and to improve positions in the commercial, industrial and residential real estate segments.

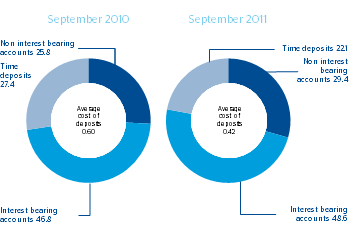

In customer funds BBVA Compass has also managed to reduce high cost deposits and increase those of lower cost. In fact, the percentage of non-interest bearing deposits out of the total rose from 25.8% at 30-Sep-2010 to 29.4% as of 30-Sep-2011.

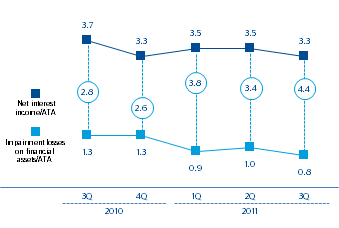

The above explains the favorable trend in deposit cost figures, which have fallen over the last year by 20 basis points from 0.62% to 0.42%. Yield on loans fell, but to a lesser extent, by 12 basis points over the same time period. Thus BBVA Compass is continuing to improve its customer spread, which as of 30-Sep-2011 stood at 3.94% (up 8 basis points from the same date the previous year and 2 basis points from the close of the previous quarter). As a result, the bank has managed to maintain its quarterly net interest income at practically the same level as in the previous quarter. In fact, BBVA Compass has the best net interest income / ATA ratio within its peer group. According to data from the second quarter of 2011, this ratio was above 3.96% (following local criteria) for the previous six quarters, while the median for the rest of the sector was 3.52%.

Regulatory pressures have not prevented BBVA Compass from making constant improvements to its fee structure. Retail lending and insurance premiums have more than offset the negative impact on service charges during the year resulting from regulatory changes. In fact, BBVA Compass actually increased service charges in this quarter, proving the bank’s swift response and ability to compensate for lost income.

With respect to other revenues, of particular note is the increase in the allocation to the Federal Deposit Insurance Corporation (FDIC). In all, the Bank’s gross income YTD stands at €1,454m (down 7.0% year-on-year).

| BBVA Compass. Loan mix (Percentage)  |

BBVA Compass. Deposit mix (Percentage)  |

|---|

BBVA Compass. Net interest income/Impairment losses on financial assets

(Percentage)

Developer loans over BBVA Compass total loan portfolio

(Percentage)

Operating expenses continue to be held in check, despite the investment in both people and technology. They increased by only 1.0% with respect to the figure for the same period last year. Overall, the operating income fell by 19.4% to €494m. However, the improvement in credit quality continues to be a key factor in the profitability of BBVA Compass. In the third quarter of 2011 all the main business units of BBVA Compass improved their credit quality on the previous quarter. NPA were down €78 million (a quarter-on-quarter drop of 5.7%), and impairment losses on financial assets year to date to September were down 36.0% year-on-year. This has not affected the bank’s coverage ratio, which was 7.3 percentage points better as of 30-Sep-2011 than on the same date last year and 1.9 percentage points better than the close of June 2011. Thus the cost of risk in annualized terms has fallen in the last 12 months from 1.89% to 1.23%, with a reduction over the quarter of 10 basis points. As a result, the net attributable profit amounted to €159m (up 28.0% year-on-year).

This means that BBVA Compass has achieved organic capital growth and maintains consistently strong core capital ratios. According to local criteria, the bank has a core capital (Tier I) ratio of 11.7% and leverage ratio of 9.5%.

BBVA Compass is divided into three main business units: Retail, Commercial banking, and Wealth Management. Retail lending increased 12.4% over the year (up 3.1% over the quarter) to €13,500m, while deposits fell by 3.7% year-on-year (–2.8% quarter-on-quarter) to €21,918m. In commercial banking, loans were up by 8.2% from September 2010 and 4.5% from June 2011 to €13,889m, while deposits were up at a year-on-year rate of 6.6% (down 1.9% over the quarter) to €8,985m.

BBVA Compass continues to stand out from the competition by customer service. Thanks to more than 50 schemes being implemented, new customer retention and cross-sell ratios have increased steadily over the last three quarters. Moreover, the Bank continues to launch new products and innovate in order to maintain its competitive edge despite the changing regulatory environment. A prime example is the introduction of the Business Rewards credit card this quarter, which offers exclusive discounts of up to 30% on QuickBooks purchases and business savings through the Visa Savings Edge scheme. The card has no annual fee attached. Other new products include a SafeSpend Card and a Charge Card, both of which offer several attractive features. Distribution networks are being improved through ongoing technological updates in branches and better access via both cell phones and the Internet. This can be seen by the 75% increase so far this year in the number of customers who access the bank through their cell phones.

Finally, employees continue to be very active in their respective communities, where they participate in both local and national initiatives. One notable project is volunteer participation to rebuild schools within the bank’s footprint, to which over 715 employees have contributed their time and effort so far this year. The “Compass For Your Cause” program, which benefits non-profit organizations, has more than tripled in the last year with a record 11,000 people taking part.