| Income statement (Million euros) |

|

|

|

|

|---|---|---|---|---|

|

|

Wholesale Banking & Asset Management | |||

|

|

Enero-Sep. 11 | ∆% | ∆% (1) | Enero-Sep. 10 |

| Net interest income | 1,153 | 0.8 | 2.3 | 1,144 |

| Net fees and commissions | 632 | 2.6 | 3.7 | 616 |

| Net trading income | 222 | (30.8) | (28.7) | 320 |

| Other income/expenses | 70 | (1.7) | (3.7) | 71 |

| Gross income | 2,077 | (3.5) | (2.1) | 2,151 |

| Operating costs | (705) | 14.5 | 15.5 | (615) |

| Personnel expenses | (419) | 11.3 | 12.1 | (376) |

| General and administrative expenses | (276) | 19.4 | 20.9 | (231) |

| Depreciation and amortization | (10) | 19.5 | 20.0 | (9) |

| Operating income | 1,372 | (10.6) | (9.2) | 1,535 |

| Impairment on financial assets (net) | (61) | 5.7 | 7.4 | (58) |

| Provisions (net) and other gains (losses) | (7) | n.s. | n.s. | 5 |

| Income before tax | 1,304 | (12.1) | (10.6) | 1,483 |

| Income tax | (382) | (8.7) | (6.9) | (419) |

| Net income | 922 | (13.4) | (12.1) | 1,064 |

| Non-controlling interests | (60) | (20.2) | (16.1) | (75) |

| Net attributable profit | 862 | (12.9) | (11.8) | 989 |

(1) At constant exchange rate.

| Balance sheet (Million euros) |

|

|

|

|

|---|---|---|---|---|

|

|

Wholesale Banking & Asset Management | |||

|

|

30-09-11 | ∆% | ∆% (1) | 30-09-10 |

| Cash and balances with central banks | 8,531 | 66.1 | 67.4 | 5,136 |

| Financial assets | 79,683 | 9.5 | (9.3) | 72,759 |

| Loans and receivables | 74,713 | 13.5 | 14.5 | 65,838 |

| Loans and advances to customers | 55,016 | 6.9 | 8.1 | 51,466 |

| Loans and advances to credit institutions and other | 19,696 | 37.0 | 36.9 | 14,372 |

| Inter-area positions | - | n.s. | n.s. | 25,955 |

| Tangible assets | 47 | 3.1 | 3.5 | 45 |

| Other assets | 2,527 | 13.0 | 13.4 | 2,237 |

| Total assets/liabilities and equity | 165,500 | (3.8) | (3.2) | 171,970 |

| Deposits from central banks and credit institutions | 53,728 | 1.2 | 2.5 | 53,075 |

| Deposits from customers | 48,972 | (21.6) | (21.3) | 62,481 |

| Debt certificates | (117) | n.s. | n.s. | 0 |

| Subordinated liabilities | 1,462 | (21.3) | (21.4) | 1,857 |

| Inter-area positions | 2,449 | n.s. | n.s. | - |

| Financial liabilities held for trading | 48,819 | 8.9 | 9.0 | 44,825 |

| Other liabilities | 6,352 | (0.1) | 1.2 | 6,358 |

| Economic capital allocated | 3,836 | 13.7 | 13.6 | 3,374 |

(1) At constant exchange rate.

WB&AM highlights in the third quarter

- Resilience of customer revenues in an especially complicated quarter for the markets.

- Leadership in several of the wholesale banking operations in Europe and Latin America

- High asset quality.

The Wholesale Banking & Asset Management (WB&AM) area handles the Group’s wholesale businesses and asset management in all the geographical areas where it operates. It is organized in three main business units: Corporate and Investment Banking (C&IB), Global Markets (GM) and Asset Management (AM).

Despite the complicated economic backdrop and the negative evolution of the financial markets, especially in the second and third quarters of 2011, the BBVA Group’s WB&AM has maintained a clear focus on the client and high recurrence and quality in its revenues. This was due to the Group’s outstanding business model, which is strongly based on a solid relationship with its customers and low leverage levels. This business model in the current economic situation allows BBVA to recover competitiveness against a backdrop that has forced other banks to announce significant deleveraging plans.

The accumulated gross income as of September stood at €2,077m, down 2.1% at constant exchange rates compared to the same period of 2010. Broken down by geographical area, Asia has posted an excellent 29.3% year-on-year growth supported by its Global Markets unit. Europe, excluding Spain, recorded a 2.7% increase.

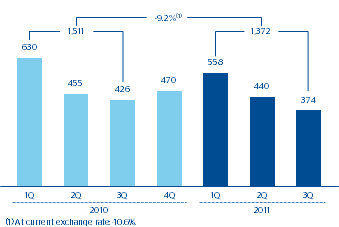

Investment in systems and the various growth plans underway in all the geographical areas have led to a 15.5% year-on-year increase in operating expenses, and resulted in an operating income amounting to €1,372m as of 30-Sep-2011, a 9.2% decrease compared to the same period of 2010.

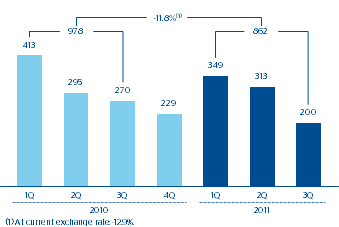

The units in this area continue to show high asset quality, with a low NPA ratio, a high coverage ratio and loan-loss provisions that represent 5.1% of the operating income. As a result of these factors, the net attributable profit in the nine months ended 30-Sep-2011 was €862m (down 11.8% as compared to September 2010).

As of September 30, 2011, this aggregate recorded gross lending to customers of €55,683m and managed €50,140m in customer funds. Its year-on-year evolution varies by geographical area. Activity was down or remained stable in the developed markets (Spain and the United States, primarily), while it was up in emerging regions (Eurasia and Latin America).

The main transactions in the Group’s wholesale business in the third quarter of 2011 are summarized below:

In equity capital markets in Spain, BBVA participated as co-lead manager in the institutional tranche of Bankia’s IPO (€3,092m). In Asia, it acted as joint lead-manager in the international tranche of CITIC Securities going public on the Hong Kong stock exchange (€1,252m). Finally, BBVA Bancomer, in Mexico, led the process of the Banregio Financial Group going public.

| WB&AM. Operating income (Million euros at constant exchange rate)  |

WB&AM. Net attributable profit (Million euros at constant exchange rate)  |

|---|

In Project Finance in Spain, BBVA signed three wind energy projects with clients like Enel Green Power and one for the Arenales solar thermal power plant with RREEF, Solar Millennium and OHL. It led the financing of the high-speed rail line between Brittany and Pays de la Loire in France and the A9 highway in Germany. Two examples of financing in Mexico include the Urbana Norte Highway and two hotel and real estate complexes with OHL, as well as the LNG Altamira Terminal. In Colombia, Chile and Peru, BBVA was selected to finance Reficar and the Andes Highway, and will also provide financial consulting for the electric train in Lima. And in the United States, it signed two projects for gas facilities in California: Walnut Creek with Edison Mission Energy and Los Esteros with Calpine, as well as mixed financing of bank facilities and bonds for Genesis. The Nextera solar thermal project should also be noted, as it is guaranteed by the US Department of Energy and is the most important transaction financed to date in the country in this sector.

In Corporate Finance, BBVA continued to consolidate its leadership position in the Spanish Merger and Acquisitions (M&A) market (15 transactions closed to date in 2011) and continues to be a key player in the American continent. In the third quarter of 2011, it provided consultancy services in four cross-border transactions: two sales of 7.7% of EDP to Endesa in two listed Brazilian companies (Ampla Energia and Ampla Investimentos), the sale of a retail package in Argentina from Repsol-YPF to private investors and, finally, the sale of Splau!, an Acciona shopping mall in Spain to Unibail-Rodamco.

Despite the situation of the credit markets, BBVA continued to support its customers through syndicated loans in the third quarter. In Europe, BBVA’s leadership in the two major transactions of acquisition financing was outstanding (SAB Miller and BHP Billiton). BBVA maintained the top position in the Dealogic rankings in corporate financing in Spain for its transactions with Red Eléctrica, FCC and Gamesa. It also led syndicated loans in other European countries for BASF, ESB, Autogrill and Vinci. Furthermore, it consolidated its leadership (second place bookrunner according to Dealogic) in Latin America with transactions such as Pemex and Nemak. In Brazil, BBVA headed the financing of Votorantim ($2.65 billion), one of the principal transactions in Latin America.

In Global Transactional Banking, the Institutional Custody unit earned the rating of “recommended” in both the domestic market category and in the Cross Border/Non-Affiliated category in the Agent Banks in Major Markets Survey carried out annually by the magazine Global Custodian. The most relevant aspect in Europe in the Transactional Trade Finance business, was the high level of activity achieved in the issue of economic guarantees on oil operations, for a total amount of US$566m in the quarter.

As regards Structured Trade Finance, it is worth noting the signing of financing for two projects for agro-industrial complexes in Angola for US$95m, the extension of a wind farm in the United Kingdom for €193m and the rehabilitation of the Laguna Verde plant in Mexico for US$500m.

As regards Global Markets, in the first nine months of 2011, this unit recorded solid earnings in customer revenues in Spain, especially in credit-linked products, which grew 23% year-on-year. Broken down by client type, all (institutional investment, corporates, companies and retail) have increased revenues and activity compared to the same period the previous year. However, the positive course of revenues from corporate clients was especially outstanding, as they were up 97%. These favorable results were possible due to the customers’ trust in the division’s products and services. The above, in turn, is reflected in the earning of first place in the categories of Best Equity Structured Products, Best Equity and Risk Management, Best OTC Equity Market and Best Wholesale and Retail Equity Structured Product, all granted by Risk España. Also, Structured Retail Products awarded Global Markets the first place in Spain as Best Manufacturer and Best Manufacturer Equity Asset Class. However, the trading business was negatively affected in the third quarter of 2011 as a result of the general decline in asset values caused by the turbid state of market conditions. BBVA maintained its leading position for yet another quarter in equity brokerage in Spain, with a market share of 15.4% to September (up 2.7 percentage points since 30-Jun-2011), 6.9 percentage points above the next competitor.

Revenues from Global Markets in the rest of Europe and Asia rose 28.5% year-on-year. Those from customers, up 20.0% and the progress of the revenues obtained with the equities product (up 55.0%) were especially remarkable. The institutional customer has a major presence in business in this area. It grew 22% in the last year, though the corporate customer, which has contributed 35% of revenues, is gaining weight.

Customer revenues in Global Markets Mexico also recorded an excellent performance, with a year-on-year growth of 22%. Those from corporates and investors were noteworthy (up 72% and 16%, respectively).

In South America, revenues from customers in Global Markets increased 20% in credit, interest rates and FX products. Corporate and retail clients presented very positive growth (up 42% and 36% year-on-year, respectively).

In the United States, revenues from customers in Global Markets increased significantly for all types of customers and in credit and interest rates products.

Finally, BBVA Asset Management, with global assets under management of €70,531m, continues to be a key player in mutual fund and pension fund management in the geographical areas in which it operates. In Spain it holds a market share of 16.8% of assets in mutual funds and is the clear leader in the pension fund sector. It maintained its leading position in the management of mutual funds in Mexico and holds 22.5% of the market share. In the rest of the countries of Latin America, the unit has continued to grow in line with previous quarters, with a year-on-year increase in assets under management in mutual and pension funds of 16%.