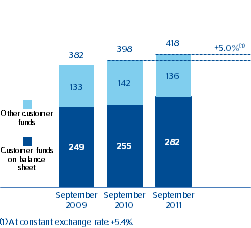

The balance of customer funds as of 30-Sep-2011 was €419 billion, a year-on-year increase of 5.0%. Off-balance-sheet funds performed worst, with a fall of 4.4%. They were strongly hit by the current turmoil in the markets.

On-balance-sheet customer funds totaled €282 billion as of 30-Sep-2011 (up 10.3% year-on-year). Of note here was the good performance of time deposits in the domestic sector thanks to the high ratio of renewals over the quarter of the time deposits gathered a year ago. As a result, this line item grew by 7.5% year-on-year. Combined with the fall in the loan-book in Spain, it has contributed to the steady narrowing of the liquidity gap in BBVA’s balance sheet. In addition, customer deposits in the non-domestic sector have fallen by 7.0% year-on-year, basically due to the negative impact of exchange rates.

| Customer fund (Million euros) |

|

|

|

|

|

|---|---|---|---|---|---|

|

|

30-09-11 | ∆% | 30-09-10 | 30-06-11 | 31-12-10 |

| Deposits from customers | 282,050 | 10.3 | 255,798 | 278,496 | 275,789 |

| Domestic sector | 146,284 | 33.2 | 109,848 | 135,420 | 133,629 |

| Public sector | 30,672 | n.s. | 7,409 | 24,905 | 17,412 |

| Other domestic sectors | 115,612 | 12.9 | 102,438 | 110,515 | 116,217 |

| Current and savings accounts | 42,215 | (7.7) | 45,740 | 44,061 | 43,225 |

| Time deposits | 51,182 | 7.5 | 47,599 | 52,188 | 49,160 |

| Assets sold under repurchase agreement and other | 22,215 | 144.1 | 9,100 | 14,266 | 23,832 |

| Non-domestic sector | 135,766 | (7.0) | 145,951 | 143,076 | 142,159 |

| Current and savings accounts | 78,127 | 15.0 | 67,930 | 75,002 | 74,681 |

| Time deposits | 54,958 | (25.4) | 73,697 | 63,320 | 61,626 |

| Assets sold under repurchase agreement and other | 2,681 | (38.0) | 4,324 | 4,754 | 5,852 |

| Other customer fund | 136,588 | (4.4) | 142,902 | 144,175 | 146,188 |

| Mutual funds | 38,361 | (9.6) | 42,422 | 40,527 | 41,991 |

| Pension funds | 73,870 | (2.2) | 75,567 | 77,051 | 78,763 |

| Customer portfolios | 24,357 | (2.2) | 24,913 | 26,596 | 25,434 |

| Total customer funds | 418,638 | 5.0 | 398,700 | 422,672 | 421,977 |

Customer funds

(Billion euros)

Off-balance sheet customer funds closed the third quarter at €137 billion, 4.4% down on the figure for the same date last year, and 5.3% down on the close of the previous quarter. Of these funds, 36.8% (€50 billion) are located in Spain, a year-on-year drop of 8.4% and a decline of 3.9% over the quarter. This can be explained largely due to the reduction in the value of the assets under management, mainly in mutual funds(down 16.4% year-on-year and 3.6% quarter-on-quarter). It is worth pointing out that according to the latest data from August 2011 the effect of this fall in BBVA is much less significant than in the rest of the system, given the more conservative profile of its mutual funds. In the third quarter of 2011, the real-estate fund BBVA Propiedad changed its legal status and became a public corporation (sociedad anónima), which means that it is no longer accounted for as a mutual fund. Because of this, the previous data have been restated to ensure that they are comparable. Pension funds totaled €17 billion (down 1.6% year-on-year and 1.4% quarter-on-quarter). BBVA has maintained its position as the leading pension fund manager in Spain, with a market share of 18.3% (June 2011 data, the latest available).

In the rest of the world, off-balance-sheet funds totaled €86 billion, with a year-on-year fall of 2.0% at current exchange rates. These funds were also affected by the fall in the value of assets under management.

| Other customer funds (Million euros) |

|

|

|

|

|

|---|---|---|---|---|---|

|

|

30-09-11 | ∆% | 30-09-10 | 30-06-11 | 31-12-10 |

| Spain | 50,225 | (8.4) | 54,802 | 52,254 | 52,482 |

| Mutual funds | 20,220 | (16.4) | 24,179 | 20,966 | 22,316 |

| Pension funds | 16,741 | (1.6) | 17,019 | 16,986 | 16,811 |

| Individual pension plans | 9,600 | (2.6) | 9,856 | 9,799 | 9,647 |

| Corporate pension funds | 7,141 | (0.3) | 7,162 | 7,186 | 7,164 |

| Customer portfolios | 13,265 | (2.5) | 13,604 | 14,302 | 13,355 |

| Rest of the world | 86,363 | (2.0) | 88,100 | 91,922 | 93,707 |

| Mutual funds and investment companies | 18,141 | (0.6) | 18,243 | 19,562 | 19,675 |

| Pension funds | 57,129 | (2.4) | 58,548 | 60,066 | 61,952 |

| Customer portfolios | 11,092 | (1.9) | 11,309 | 12,294 | 12,080 |

| Other customer funds | 136,588 | (4.4) | 142,902 | 144,175 | 146,188 |