Why invest in BBVA

Strategic priorities

Purpose, values and strategic priorities

We are a purpose driven organization with a clear purpose “ to bring the age of opportunity to everyone”, solid values and six strategic priorities:

- Improving our clients’ financial health: Help our clients to make better decisions with their money and manage their finances to achieve their life and business goals.

- Helping our clients transition toward a sustainable future: Progressively align our activity with the Paris Agreement and advise our clients with the transition towards a more sustainable future.

- Reaching more clients: Accelerate profitable growth by being where our clients are, leveraging our digital channels and those of third parties.

- Driving operational excellence: Provide the best customer experience with simple, automated processes and a continuous focus on risk management and optimal capital allocation.

- The best and most engaged team: A diverse and empowered team guided by our Purpose, Values, and Behaviors, propelled by a talent development model that creates growth opportunities for all team members.

- Data and Technology: using advanced data analytics and secure and reliable technologies as the main levers to build distinctive high-quality solutions and deliver on our strategy.

BBVA's Strengths

In BBVA we are a customer-centric global financial services group (BBVA in brief) focused on shareholder value creation. Our 5 main strengths are:

-

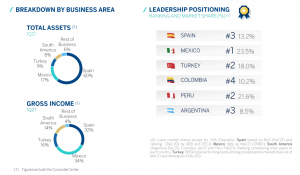

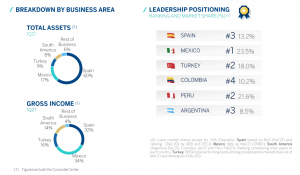

Resilient operating income thanks to a well-diversified footprint with leadership positioning

-

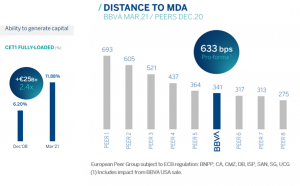

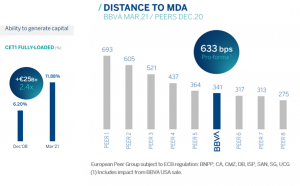

Sound capital position with a proven capacity to generate capital and well above requirements

-

Comfortable liquidity position at the Group level and all main subsidiaries in a safe and resilient Multiple Point of Entry Strategy (link)

-

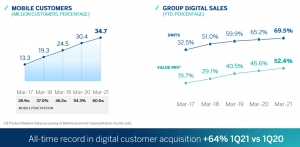

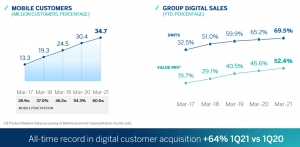

Digital edge as a competitive advantage

-

Helping our clients transition towards a more sustainable future: a massive business opportunity

In BBVA we are a customer-centric global financial services group (BBVA in brief) focused on shareholder value creation. Our 5 main strengths are:

-

Resilient operating income thanks to a well-diversified footprint with leadership positioning

-

Sound capital position with a proven capacity to generate capital and well above requirements

-

Comfortable liquidity position at the Group level and all main subsidiaries in a safe and resilient Multiple Point of Entry Strategy (link)

-

Digital edge as a competitive advantage

-

Helping our clients transition towards a more sustainable future: a massive business opportunity

Updated page 13 July 2021