Sustainable Financing

Pledge 2025

Pledge 2025 Progress

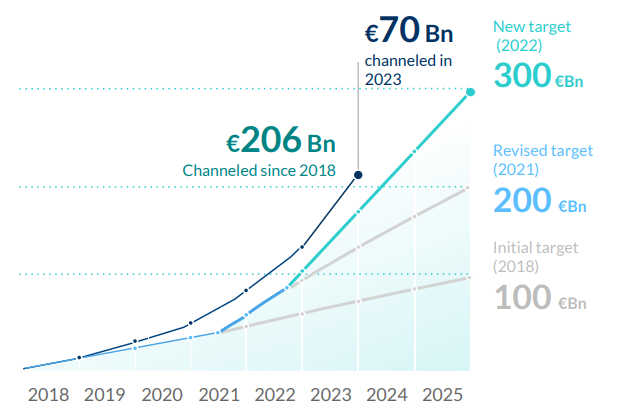

BBVA is committed to channelling 300 billion in sustainable financing until 2025.

Sustainable financing breakdown

BBVA promotes sustainable solutions focused on identifying opportunities arising from climate change and inclusive growth and creates value propositions and offers advice for wholesale and retail clients.

Sustainable issuances

Sustainable issuances

BBVA is one of the most experienced financial institutions in the green bond market. The bank’s activity started in 2007, when it participated in the issue of the first green bond by the European Investment Bank. Since then, the bank has led, structured, provided guidance on, and acted as the placement entity for social and green bond issues by clients in Europe, the United States, and Latin America.

In April 2018, BBVA published its framework for issuing sustainable bonds, linked to The UN Sustainable Development Goals (SDGs). A few days later, it issued its first green bond by €1 billion in a Senior non Preferred format. At the time, BBVA’s inaugural green bond issuance was the largest in the euro area by a financial institution. BBVA has become one of the most active players in the green bond market.

Find all the information on the BBVA sustainable bond issue here.

BBVA Sustainable Bonds: Framework, Issuances and Reports

All the information on the BBVA green bond issue

Sustainable issuances

BBVA is one of the most experienced financial institutions in the green bond market. The bank’s activity started in 2007, when it participated in the issue of the first green bond by the European Investment Bank. Since then, the bank has led, structured, provided guidance on, and acted as the placement entity for social and green bond issues by clients in Europe, the United States, and Latin America.

In April 2018, BBVA published its framework for issuing sustainable bonds, linked to The UN Sustainable Development Goals (SDGs). A few days later, it issued its first green bond by €1 billion in a Senior non Preferred format. At the time, BBVA’s inaugural green bond issuance was the largest in the euro area by a financial institution. BBVA has become one of the most active players in the green bond market.

Find all the information on the BBVA sustainable bond issue here.

BBVA Sustainable Bonds: Framework, Issuances and Reports

All the information on the BBVA green bond issue