Capital and shareholders

Capital base

The BBVA Group's CET1 fully loaded ratio stood at 12.88% as of December 31, 2024, which allows it to maintain a large management buffer over the Group's CET1 requirement as of that date (9.13%6), and is also above the Group's target management range of 11.5% - 12.0% of CET1.

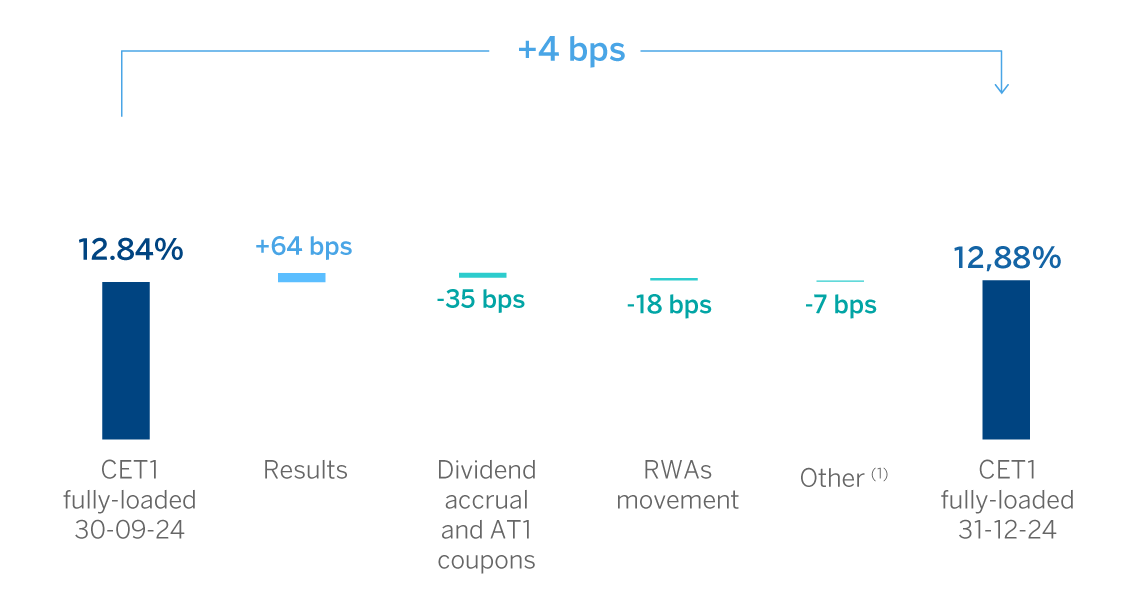

Regarding the specific variation during the quarter, the Group’s CET1 fully loaded increased by 4 basis points with respect to the September level (12.84%).

The strong earnings generation during the quarter (+64 basis points) net of shareholder remuneration and payment of capital instruments (CoCos), generated a positive contribution of +29 basis points to CET1 ratio, which more than compensate the growth of risk-weighted assets (RWA) derived from the organic growth of activity in constant terms and the risk transfer initiatives in the period (consumption of -18 basis points), in line with the Group's strategy of continuing to promote profitable growth.

Among the remaining impacts draining the ratio -7 basis points, those associated with market variables stand out, particularly the negative evolution in the quarter due to the performance of the main currencies (highlighting the impact of the US dollar evolution) and, to a lesser extent, the valuation of fixed income portfolios.

QUARTERLY EVOLUTION OF THE CET1 FULLY LOADED RATIO

(1) Includes, among others, FX and mark to market of HTC&S portfolios, minority interests, and a positive impact in OCI equivalent to the Net Monetary Position value loss in hyperinflationary economies registered in results.

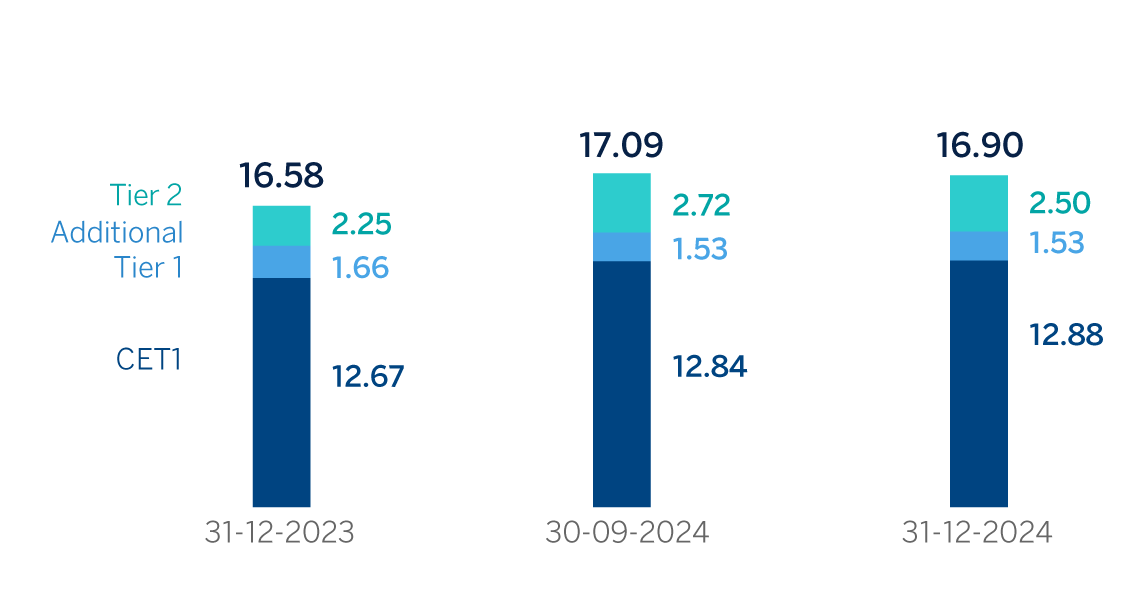

The AT1 fully loaded ratio stood at 1.53% not showing any increase (0 basis points) compared to September 30, 2024. Merely impacted in the quarter by organic RWA growth, offset by the currency effect.

The Tier 2 fully loaded ratio has experienced a significant variation in the quarter (-23 basis points), mainly impacted by the announcement of the early redemption of one €1.0 billion issuance, which means, for all practical purposes, the end of its computability. In addition, in Turkey, a USD 750 million of subordinated debt was issued, a USD 134 million issuance has been partially redeemed, and an issuance amounting 750 million Turkish lira was announced to be fully redeemed, to be executed in February.

As a consequence of the foregoing, the consolidated fully loaded total capital ratio stood at 16.90% as of December 31, 2024, above the total capital requirements (13.29%6).

Following the latest decision of the SREP (Supervisory Review and Evaluation Process), which came into force on January 1, 2025, BBVA Group must maintain at consolidated level a total capital ratio of 13.29% and a CET1 capital ratio of 9.13%6, including a Pillar 2 requirement at consolidated level of 1.68% (a minimum of 1.02% must be satisfied with CET1), of which 0.18% is determined on the basis of the ECB's prudential provisioning expectations, and must be satisfied by CET1.

FULLY LOADED CAPITAL RATIOS

(PERCENTAGE)

| CAPITAL BASE (MILLIONS OF EUROS) | |||||||

|---|---|---|---|---|---|---|---|

| 31-12-24 (2) | 30-09-24 | 31-12-23 | 31-12-24 (2) | 30-09-24 | 31-12-23 | ||

| Common Equity Tier 1 (CET1) | 50,799 | 48,715 | 46,116 | 50,799 | 48,715 | 46,116 | |

| Tier 1 | 56,822 | 54,503 | 52,150 | 56,822 | 54,503 | 52,150 | |

| Tier 2 | 9,858 | 10,341 | 8,182 | 9,858 | 10,341 | 8,182 | |

| Total capital (Tier 1 + Tier 2) | 66,680 | 64,844 | 60,332 | 66,680 | 64,844 | 60,332 | |

| Risk-weighted assets | 394,468 | 379,520 | 363,915 | 394,468 | 379,520 | 363,915 | |

| CET1 (%) | 12.88 | 12.84 | 12.67 | 12.88 | 12.84 | 12.67 | |

| Tier 1 (%) | 14.40 | 14.36 | 14.33 | 14.40 | 14.36 | 14.33 | |

| Tier 2 (%) | 2.50 | 2.72 | 2.25 | 2.50 | 2.72 | 2.25 | |

| Total capital ratio (%) | 16.90 | 17.09 | 16.58 | 16.90 | 17.09 | 16.58 | |

(1) The difference between the phased-in and fully loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873). For the periods shown in this table, there are no differences between phased-in and fully loaded ratios due to the aforementioned temporary treatment.

(2) Preliminary data.

As of December 31, 2024, the phased-in leverage ratio stood at 6.81%7 (6.81% fully loaded), which represents an increase of 21 basis points compared to September 2024.

| LEVERAGE RATIO (FULLY LOADED) | |||

|---|---|---|---|

| 31-12-24 (1) | 30-09-24 | 31-12-23 | |

| Exposure to Leverage Ratio (fully loaded) (million euros) | 834,488 | 825,479 | 797,888 |

| Leverage ratio (fully loaded) (%) | 6.81 | 6.60 | 6.54 |

(1) Preliminary data.

With respect to the MREL ratios8 achieved as of December 31, 2024, these were 27.92% and 12.10%, respectively for MREL in RWA and MREL in LR, reaching the subordinated ratios of both 23.13% and 10.03%, respectively. A summarizing table is shown below:

| MREL | |||

|---|---|---|---|

| 31-12-24 (1) | 30-09-24 | 31-12-23 | |

| Total own funds and eligible liabilities (million euros) | 63,887 | 62,415 | 56,603 |

| Total RWA of the resolution group (million euros) | 228,796 | 216,669 | 214,757 |

| RWA ratio (%) | 27.92 | 28.81 | 26.36 |

| Total exposure for the Leverage calculation (million euros) | 527,804 | 544,565 | 517,470 |

| Leverage ratio (%) | 12.10 | 11.46 | 10.94 |

(1) Preliminary data.

On March 27, 2024 the Group made public that it had received a communication from the Bank of Spain regarding its new MREL requirement 22.79%9 (Minimum Requirement for own funds and Eligible Liabilities). In addition, BBVA must reach, also as from March 27, 2024, a volume of own funds and eligible liabilities in terms of total exposure considered for purposes of calculating the leverage ratio of 8.48% (the “MREL in LR”)10. These requirements do not include the current combined buffer requirement, which, according to current regulations and supervisory criteria, is 3.64%11. Given the structure of the resolution group's own funds and eligible liabilities, as of December 31, 2024, the Group meets the aforementioned requirements.

Likewise, with the aim of reinforcing compliance with these requirements, BBVA has made several debt issuances during the year 2024. For more information on these issuances, see "Structural risks" section within the "Risk management" chapter.

Shareholder remuneration

2023

Regarding shareholder remuneration, as approved by the General Shareholders´ Meeting on March 15, 2024, in its first item on the agenda, on April 10, 2024, a cash payment of €0.39 gross per each outstanding BBVA share entitled to receive, such amount was made against the 2023 results, as an additional shareholder remuneration for the financial year 2023. Thus, the total amount of cash distributions for 2023, taking into account the € 0.16 gross per share that was distributed in October 2023, amounted to €0.55 gross per share.

Total shareholder remuneration of 2023 includes, in addition to the cash payments mentioned above, the remuneration resulting from BBVA's buyback program for the repurchase of own shares announced on January 30, 2024 for a maximum amount of €781m, and which started being executed on March 4, 2024. Likewise, BBVA announced on April 9, 2024 the completion of the share buyback program upon reaching the maximum monetary amount, having acquired a total number of 74,654,915 own shares, between March 4 and April 9, 2024, representing, approximately, 1.28% of BBVA's share capital as of such date. On May 24, 2024, BBVA notified through an Other Relevant Information notice a partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 15, 2024, under item 3 of the agenda through the reduction of BBVA’s share capital in a nominal amount of €36,580,908.35 and the consequent redemption, charged to unrestricted reserves, of 74,654,915 own shares of €0.49 par value each acquired derivatively by the Bank in execution of the own share buyback program scheme and which were held as treasury shares.

2024

Likewise, the Bank announced by means of an inside information notice (información privilegiada) dated September 26, 2024, that the Board of Directors of BBVA had agreed to pay an interim dividend for the year 2024, in the amount of 0.29 gross euros per share, which was paid on October 10, 2024.

Additionally, BBVA announced on January 30, 2025 by means of an inside information notice (información privilegiada) it is expected to be submitted to the relevant governing bodies for their consideration a cash gross distribution in the amount of €0.41 per share, to be paid presumably on April as final dividend of 2024 and the execution of a Share Buyback Program of BBVA for an amount of €993m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start. Thus, the total distribution for the year 2024 will reach €5,027m, a 50% of the net attributable profit, of which €0.70 gross per share will be distributed in cash, taking into account the payment in cash of €0.29 gross per share paid in October 2024 as interim dividend of the year.

As of December 31, 2024, BBVA’s share capital amounted to €2,824,009,877.85 divided into 5,763,285,465 shares.

| SHAREHOLDER STRUCTURE (31-12-24) | |||||

|---|---|---|---|---|---|

Number of shares | |||||

| Number | % | Number | % | ||

| Up to 500 | 307,402 | 43.0 | 56,461,642 | 1.0 | |

| 501 to 5,000 | 318,708 | 44.6 | 565,418,920 | 9.8 | |

| 5,001 to 10,000 | 47,392 | 6.6 | 332,153,648 | 5.8 | |

| 10,001 to 50,000 | 36,641 | 5.1 | 700,292,145 | 12.2 | |

| 50,001 to 100,000 | 2,541 | 0.4 | 173,186,182 | 3.0 | |

| 100,001 to 500,000 | 1,137 | 0.2 | 201,401,057 | 3.5 | |

| More than 500,001 | 248 | 0.03 | 3,734,371,871 | 64.8 | |

| Total | 714,069 | 100,0 | 5,763,285,465 | 100,0 | |

Note: in the case of shares kept by investors through a custodian placed outside Spain, only the custodian will be considered as a shareholder, which is who appears registered in the accounting record of book entries, so the number of shareholders stated does not consider those indirect holders.

On July 5, 2024, BBVA held an Extraordinary General Shareholders' Meeting. Among the agreements adopted by the said meeting was approval of an increase in the share capital of BBVA, S.A. up to a maximum nominal amount of €551,906,524.05, by issuing and putting into circulation of up to 1,126,339,845 ordinary shares with a par value of €0.49 each of them, for the purpose of covering the consideration of the voluntary tender offer for the acquisition of up to 100% of the shares of Banco de Sabadell, S.A. launched by BBVA.

Ratings

During 2024, BBVA’s rating has continued to demonstrate its strength and all agencies have maintained their rating in the A category. In March, Moody´s changed its long-term outlook on the senior preferred debt from stable to positive maintaining its rating in A3, and DBRS communicated the result of its annual revision of BBVA confirming the rating in A (high) with a stable outlook, S&P reviewed BBVA´s rating and outlook unchanged in June (A, stable), and for its part, Fitch maintained without changes BBVA´s rating and outlook (A-, stable) in September. The following table shows the credit ratings and outlooks assigned by the agencies:

| RATINGS | |||

|---|---|---|---|

| Rating agency | Long term (1) | Short term | Outlook |

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody's | A3 | P-2 | Positive |

| Standard & Poor's | A | A-1 | Stable |

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating, respectively, to BBVA’s long term deposits.

6 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of September 30, 2024.

7 Preliminary leverage ratio as of the date of publication. 8 Calculated at subconsolidated level according to the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB ("Single Resolution Board"). The resolution group is made up of Banco Bilbao Vizcaya Argentaria, S.A. and subsidiaries that belong to the same European resolution group. That implies the ratios are calculated under the subconsolidated perimeter of the resolution group. Preliminary MREL ratios as of the date of publication. 9 The subordination requirement in RWA is 13.50%. 10 The subordination requirement in Leverage ratio is 5.78%. 11 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of September 30, 2024.