In the first quarter of 2013 the global economy has shown signs of recovery, although growth remains below its trend level. There are still big differences by geographical area.

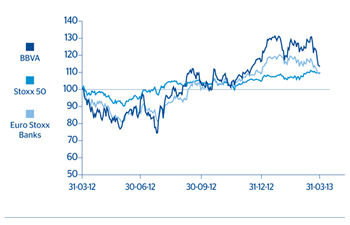

From the point of view of the markets, the quarter began with a positive general mood and a drastic reduction in the perception of risks for the euro zone. This was possible thanks to the decisive intervention measures taken by the ECB in mid-2012. However, the uncertainty surrounding Italy, following the general elections in February, and the collapse of the banking system in Cyprus in March, have renewed the focus on the political and systemic risks in the area. As a result, they have been the main factors responsible for the reversal in market sentiment. Against this background, the general European index Stoxx 50 closed March with quarterly gains of 4.7%. In contrast, the Ibex 35 and the euro zone banks index, Euro Stoxx Banks, ended the period in the red (down 3.0% and 8.8%, respectively), in part reflecting the market’s negative bias toward peripheral countries and the financial sector.

BBVA’s earnings for the fourth quarter of 2012 have once again confirmed the high solvency level and sound liquidity position of the Group in an extremely complex environment. Equity analysts have positively valued both the Group’s balance sheet management and the standout performance of revenue in all business areas, which has enabled BBVA to comfortably absorb the loan-loss and real-estate provisions made throughout the year, in particular in Spain. Expenses have grown at a slower pace than revenue, despite the significant investment made in expansion plans in emerging economies. Risk indicators have performed as expected, with an NPA ratio below the average of its main competitors.

After rising more than 12.0% in early 2013 over the close of 2012, following the recent developments in Cyprus the BBVA share closed the quarter at €6.76 per share, a decline of 2.8%. This fall is less than that registered by the Ibex 35 and, more so, by the Euro Stoxx Banks index. This represents a market capitalization of €36,851m, a price/book value ratio of 0.8, a P/E of 8.7 (calculated on the average profit for 2013 estimated by the consensus of Bloomberg analysts) and a dividend yield of 6.2% (also obtained according to the average dividend per share estimated by analysts on the share price at March 28).

The average daily volume traded over the quarter rose significantly compared to the figure recorded from October to December 2012, with a 30.5% rise in the number of shares to 69 million and a 51.9% increase in euros to 515 million.

Shareholder remuneration for 2012 remains at €0.42 per share. The Annual General Meeting held on March 15, 2013 approved the implementation of the flexible remuneration system known as “dividend option” through two capital increases charged to voluntary reserves. The first free-of-charge capital increase is taking place in April. Shareholders will receive a free allotment right for each BBVA share held at 23:59 hours (Madrid time) on April 5, 2013, which will entitle them to receive one newly-issued BBVA share for every 56 rights. Likewise the shareholder may sell the free allotment right to BBVA or on the market at any time during their trading period. According to the expected calendar, the new shares will be allocated on April 30, 2013, subject to obtaining all necessary authorizations.

The BBVA share and share performance ratios

|

|

31-03-13 | 31-12-12 |

|---|---|---|

| Number of shareholders | 990,113 | 1,012,864 |

| Number of shares issued | 5,448,849,545 | 5,448,849,545 |

| Daily average number of shares traded | 69,017,977 | 52,880,032 |

| Daily average trading (million euros) | 515 | 339 |

| Maximum price (euros) | 7.86 | 7.06 |

| Minimum price (euros) | 6.60 | 5.82 |

| Closing price (euros) | 6.76 | 6.96 |

| Book value per share (euros) | 8.55 | 8.04 |

| Market capitalization (million euros) | 36,851 | 37,924 |

| Price/Book value (times) | 0.8 | 0.9 |

| PER (Price/Earnings; times) | 8.7 | 21.5 |

| Yield (Dividend/Price; %) | 6.2 | 6.0 |

Share price index

(31-03-12=100)