At the end of the first quarter of 2013, Mexico continues to show strong commercial performance. Lending continues to be driven mainly by the retail segment, while the most significant aspect as regards customer funds is the strong performance of low-cost deposits.

Performing loans managed by the area are up 6.8% year-on-year to €40,176m as of 31-Mar-2013.

The retail portfolio, which includes consumer loans, credit cards, mortgages and lending to small businesses, increased 6.5%. Lending to small businesses closed the quarter growing above 20% since the end of March 2012. Consumer finance and credit cards together are up 8.8% over the same period, boosted mainly by credit cards.

In the wholesale portfolio, which includes loans to corporations, SMEs and the public sector, it is particularly significant the strong performance of SMEs, which has grown at double-digit rates since the third quarter of 2011 and at the end of March was up 14.4% year on year thanks, among other factors, to the increase in the customer base and banking penetration. Disintermediation of bank loans continues in the corporate segment. Thus, in the first quarter of the year BBVA Bancomer continued to support its customers by placing USD 860m of bonds on the capital markets.

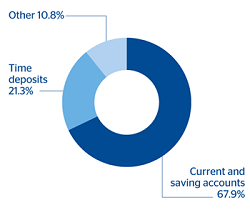

Customer funds, which include on-balance-sheet deposits, repos, mutual funds and other off-balance sheet funds, grew 2.2% since the end of March 2012 and totaled €63,830m as of 31-Mar-2013. The best performing items are demand deposits from retail customers, which are up 7.0%. Assets under management in mutual funds amount to €18,612m, up 8.1% compared to the same period last year.

Lastly, the trend in the insurance business in Mexico continues to be favorable. There has been a significant increase in the investment product linked to a life insurance policy, called Inversión Libre Patrimonial (ILP - Free Wealth Investment). The net attributable profit of the insurance business stands at €59m, up 14.8% on the figure posted for the first quarter of 2012, due mainly to the low levels of claims.

Mexico. Performing loans breakdown(March 2013) |

Mexico. Deposits from customers breakdown(March 2013) |

|---|---|

|

|