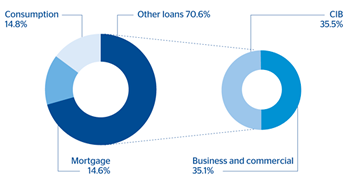

Performing loans in the area as of 31-Mar-2013 amounted to €29,745m, a year-on-year decline of 8.7% and a rise of 1.0% on the figure at the close of 2012. The most notable elements once more are the positive performance of the retail segment and the deleveraging process underway in the wholesale business in the area. This is reflected in the 2.9% year-on-year rise in residential mortgage portfolios and the 14.3% decline in commercial lending.

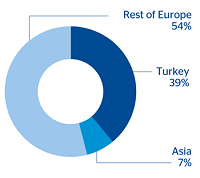

The stake in Garanti accounts for 38.8% of lending in the area, at €11,556m, a year-on-year rise of 18.3%. This largely offsets the 25.1% decline in lending to wholesale customers. With respect to lending activity in Garanti, the rise in lira-denominated loans (up 6.8% since the end of 2012) has been above the average in the Turkish sector (up 5.6%) and was boosted by mortgages (up 6.5%) and personal loans, the so called “general-purpose loans” (up 7.6%).

From the point of view of risk indicators in the area, the general tone in the quarter is of stability. The NPA ratio ended the quarter at 3.0% and the coverage ratio remains at 87%, the same level as at the close of 2012. The cumulative risk premium closed the quarter at 1.14%.

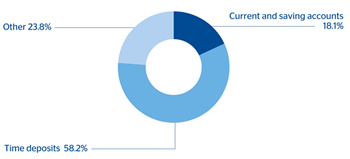

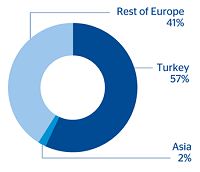

The most significant aspect of the volume of on-balance sheet customer funds (excluding repos) over the quarter is the faster pace of its rate of growth. Customer deposits closed 31-Mar-2013 at €17,956m, an 8.9% rise on the figure at the close of December 2012. Two factors explain this favorable trend. First, the deposit gathering in the wholesale segment continues at a good pace, as it had already been observed in the third quarter of 2012. Second, there was a notable performance of the Garanti balances, in particular Turkish lira deposits, which have grown above the sector average (up 11.6% since the end of 2012 compared with a rise of 1.6% in the sector).

Eurasia. Performing loans breakdown(March 2013) |

Eurasia. Deposits from customers breakdown(March 2013) |

|---|---|

|

|

Eurasia. Lending breakdown by geography(31-03-2013) |

Eurasia. On-balance sheet customer funds breakdown by geography(31-03-2013) |

|---|---|

|

|