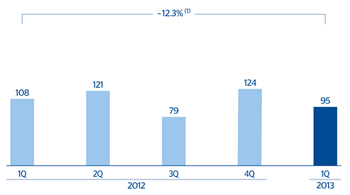

In the first quarter of 2013, the net attributable profit for the United States stood at €95m, down 12.3% on the figure reported for the same period last year. Worth highlighting are the earnings of BBVA Compass, which increased by 3.2% over 12 months to €90m.

With respect to revenue, the low interest rate environment and very flat curves continue to have a negative impact on net interest income, which is down 9.9%. These factors, combined with the decline in income from fees and commissions (down 13.0% year-on-year), associated mainly with the regulatory changes, has resulted in gross income falling to €515m, 7.9% below the figure for the first quarter of 2012.

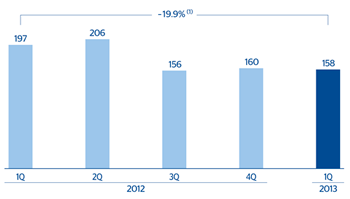

The area continues to manage its operating expenses efficiently by applying a strict cost control policy. As a result, this heading has declined once again: down 1.4% over the year (down 4.6% compared with the previous quarter). As a consequence, operating income totaled €158m, 19.9% down on the first quarter of 2012.

Impairment losses on financial assets totaled €17m, a decline of 38.3% year-on-year. The cumulative risk premium as of 31-Mar-2013 once again improved and ended at 0.18% (0.29% 12 months before).

Finally, the solvency ratios of BBVA Compass under local criteria remained very sound. According to the figures available for the first quarter, the bank is in the top quartile of its peer group, with a Tier I ratio of 11.9% and a Tier I Common ratio of 11.7%.

The United States. Operating income(Million euros at constant exchange rate) |

The United States. Net attributable profit(Million euros at constant exchange rate) |

|---|---|

(1) At current exchange rate: -20.2%. |

(1) At current exchange rate:-12.5%. |