There was a strong recovery in the European financial sector over the third quarter of 2012. The robust performance of peripheral country banks in the equity markets was particularly outstanding. There were a number of factors behind this change. The most important of these include the announcements of a single bank supervision mechanism in the euro zone and a new program of ECB secondary market purchases (OMT), subject to a previous request. Regarding Spain, a conditionality agreement has been established to aid the banking sector linked to the publication of the “bottom-up stress test” by Oliver Wyman.

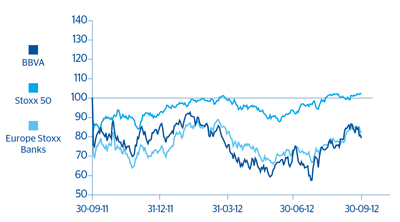

These factors resulted in a revaluation of the European banking sector. The Stoxx Banks index went up 11.2% in the quarter, outperforming the general Stoxx 50 equity market index (+5.8%). Likewise, Spain’s Ibex 35 rose 8.5% between June and September 2012, compared to an 11.3% fall in the previous quarter.

BBVA’s results in the second quarter of 2012 were favorably received by analysts. They particularly valued the Bank’s strong solvency levels, as subsequently ratified in Oliver Wyman’s “bottom-up stress test”, which highlighted the strength of the Bank’s capital position even in an extremely adverse scenario. By business area, the performance of revenue in general, and net interest income in particular, was also well received. In Spain, BBVA was set apart by its superior asset quality compared to its peers.

Despite considering that the Spanish macroeconomic conditions will continue to put pressure on the area’s earnings, analysts considered that the strength and favorable performance of the Group’s businesses in other geographic areas would be sufficient to offset this effect over the coming quarters. Earnings in South America surprised positively, thanks to its high revenue generation capacity. The USA, Turkey, Asia and, to a lesser extent, Mexico also produced better than expected results.

Against this backdrop, the BBVA share gained 8.6% over the quarter to €6.11 per share, resulting in a market capitalization of €32,901m. This represents a price/book value of 0.8, a P/E of 15.6 (calculated on the average profit for 2012 estimated by the consensus of Bloomberg analysts) and a dividend yield of 6.9% (also calculated according to the average dividend per share estimated by analysts for 2012 and the share price as of September 30, 2012). The improvement in the BBVA share is in line with that of the Ibex 35 (+8.5%), but slightly below the performance of the European sector as a whole (Stoxx Banks +11.2%, and Euro Stoxx Banks +12.8%).

As regards shareholder remuneration, BBVA maintained its dividend policy. On September 14 it announced the distribution of €0.10 per share under the “dividend option” flexible remuneration system agreed at the AGM on March 16, 2012. This program offers shareholders the option to receive the dividend in newly issued BBVA shares or in cash. Around 80% of shareholders opted to receive newly issued BBVA shares, which once more confirms the sucess of this new remuneration system.