The net attributable profit for the quarter was €146m, while the cumulative figure through September stands at €1,656m. Excluding the charge for the impairment on the assets related to the real estate sector in Spain and the badwill generated by the incorporation of Unnim, the adjusted net attributable profit amounts to €971m over the quarter, with a year to date figure of €3,345m. To sum up, the BBVA Group continues to generate sound earnings despite the difficult environment.

By business areas, Spain posted a €532m loss. Excluding the charge for the impairment of real estate assets, the area generated cumulative adjusted earnings through September of €848m. Eurasia generated €813m, Mexico €1,300m, South America €1,014m and the United States €341m.

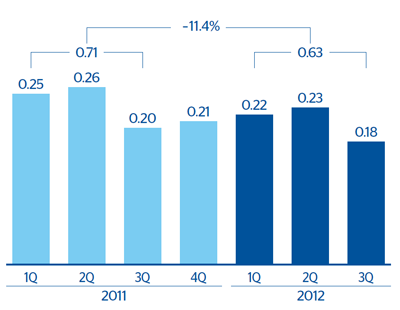

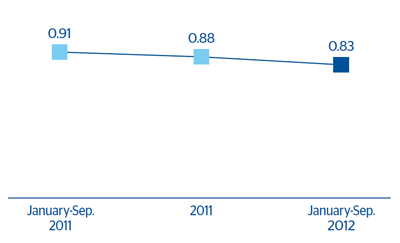

Finally, earnings per share (EPS) between January and September 2012 were €0.32 (€0.63 adjusted EPS); return on total average assets (ROA) 0.46% (0.83% adjusted); return on equity (ROE) 5.3% (10.7% adjusted); and return on equity excluding goodwill (ROTE) 6.7% (13.5% adjusted).