At the close of the third quarter of 2012, the Group’s primary asset quality indicators continued stable and still compare favorably with those of most of its peers.

BBVA closed September 2012 with a volume of total risks with customers (including contingent liabilities) of €417,405m, 2.0% up on the figure as of 30-Jun-2012. The main reason for this is the incorporation of Unnim, and to a lesser extent the growth in lending in emerging countries. Not taking into account the balances of the Catalan bank, the total amount of risks fell by 2.6% since the close of June 2012, due to the deleveraging process being undertaken in Europe.

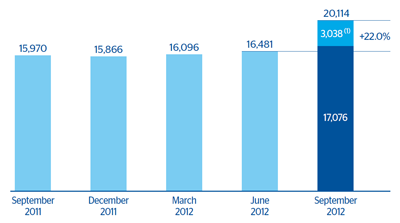

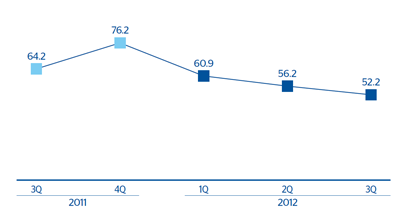

Non-performing assets closed as of 30-Sep-2012 at €20,114m, a rise of over €3,600m over the quarter. Of this total, 84% is basically due to the integration of Unnim balances. At the close of September Unnim’s NPA stood at €3,038m, but with a high coverage ratio. The rest of the increase can be explained by the worsening NPA ratio in Spain, in line with existing forecasts. In terms of variations in NPA, apart from the incorporation of Unnim and the rise of the NPA ratio in Spain, there was a lower level of both additions to NPA and recoveries. The latter, however, have slowed in response to seasonal factors affecting this quarter, above all in Spain. The ratio of recoveries to additions to NPA stood at 52.2%.

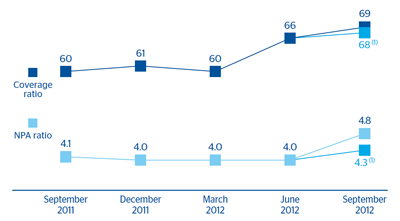

As a result, the Group’s NPA ratio at the end of September 2012 stood at 4.8%, up 79 basis points over the quarter. Of this rise, 53 basis points are the result of the aforementioned integration of Unnim. Excluding the Catalan bank, the ratio would be 4.3%, 26 points more than on 30-Jun-2012, basically as a result of the deterioration of the economic situation in Spain, combined with the financial deleveraging process underway in the country. In Mexico, the NPA ratio remains stable (4.1% at the end of September), while it has increased in Eurasia, although it continues at very low levels (1.7% compared with 1.4% in the previous quarter). In the United States, it fell significantly to 2.4% (2.8% as of 30-Jun-2012). Finally, the ratio in South America dropped slightly from 2.3% at the end of June 2012 to 2.2% at the close of September.

Coverage provisions for customer risk increased over the quarter by 28.2% to €13,877m, mainly due to a significant increase in provisions in Spain and the incorporation of Unnim. As a result, the Group’s coverage ratio has improved by 3.3 percentage points to 69%. By business area, Spain, the United States and South America increased their ratios to 59%, 94% and 142%, respectively, while Mexico closed the quarter at 107% and Eurasia at 114%.